Pretty much anything that's important these days is material. High material, medium material, low material... material for the business, material for stakeholders.. materiality assessments, materiality analyses, materiality matrices. We can't get enough of materiality. In fact, materiality has become so commonplace that it's almost materially meaningless. Since the coming-of-age of materiality via G4 in 2013, and the subsequent move to GRI Standards published in 2016, you are not on the map if your map is not material. While companies publish a list of material issues, at whatever level of granularity they (arbitrarily) choose, by and large, in many, many cases, the list does not really influence sustainability strategy, stakeholder relationships or sustainability reporting. It's often a list of broad-brush, carefully-massaged any-company issues that can be universally relevant. So what's the point of conducting a materiality assessment, if all you are going to come up with is what everybody already knows?

We love it when we have a nice matrix. If it's on a matrix, it must be right, right? The matrix surely indicates that companies have embraced materiality and that give us great comfort. The matrix must be a result of something, the company must have done the work, they must have truly understood what's important in terms of their impacts on society. Yes, materiality matrices inspire the warm fuzzies about a company and its reporting. If there's a matrix, all is well with the world.

So who are we kidding? I am reminded of Woodie Allen's well-known observation that "80% of success is showing up", and this certainly appears to be the driving motivator for many materiality matrices. The remaining 20% is the differentiator. A materiality matrix without this 20% is like an iPhone without IOS.

80% of the outcome of any materiality process is a known given before the process even starts. This is why:

So, 80% of the issues are predictably material and do not need extensive analysis paralysis to determine. Engaging stakeholders then becomes an exercise that helps determine the remaining 20%, or fine-tune the prioritization. That is, of course, if you actually engage... and if you engage with stakeholders that are relevant. Not all stakeholders are created equal and not all should be represented with equal voice. Sending out a survey may sound like fun, and 500 responses may sound robust, but if the 500 voices are a random mix, and if the survey is the only tool you use, then it's quite possible that your outcome will not reflect a differentiating set of issues for your company.

GRI Standards, the most widely used sustainability reporting framework, has in part been responsible for creating this double-edged sword. On the one hand, the notion that companies should focus on what's most important/impactful (material) makes absolute sense. On the other hand, what's the point in going through a whole process to articulate the obvious? Maya Angelou is quoted as saying: "Ask for what you want and be prepared to get it." (This works well for me at the ice cream store). GRI asked for a list of material priorities - and that's exactly what GRI is getting in GRI Standards-based reports (and G4 reports before them). But is that really what GRI wanted? A generic list of material topics that are relevant to any company? While GRI Standards also ask for disclosures about stakeholders engaged and topics raised by them, responses by companies to this disclosure are often template-ish and not necessarily correlating to the final list of material topics presented.

Let's recap - my assertion is this:

There should be a harmonized standard baseline of disclosures that are relevant to all companies - some will be more critical than others for different companies - but they are relevant - and material - for all. I call this Operational Materiality.

Then we should have materiality that is precise enough to differentiate - focusing on the specific aspects of a company's impacts that are a directly relevant to its business, the locations it operates in and the influence it has on society. Let's call that Precision Materiality.

I recently came across a framework which shows how this Operational Materiality part might work. It was via an interesting interview on Forbes by Christopher P Skroupa of Evan Harvey, the Global Head of Sustainability for Nasdaq. Evan Harvey explains: "Nasdaq published an ESG Reporting Guide for our European markets in March, 2017. The Guide is meant to provide an overview of the “business case” for sustainability strategy, management and performance disclosure. We identify 33 different metrics across the ESG space — the common denominators in global reporting frameworks, the most revealing and insightful measurements of company vitality — and make the justification for each. Reaction has been almost uniformly positive, and many investors have thanked us for helping to declutter a crowded data landscape." I looked at this guide, which I hadn't seen before.

The guide is primarily written to help companies traded on Nasdaq provide the information that investor markets need. The guide presents a set of 33 "Operational Materiality" metrics that all companies should report.

For each metric, there is an explanation, following the format;

So who are we kidding? I am reminded of Woodie Allen's well-known observation that "80% of success is showing up", and this certainly appears to be the driving motivator for many materiality matrices. The remaining 20% is the differentiator. A materiality matrix without this 20% is like an iPhone without IOS.

80% of the outcome of any materiality process is a known given before the process even starts. This is why:

- There are topics that are universally relevant - climate change, energy consumption, employee rights, anti-corruption - this is just a selection of issues that are relevant for any company anywhere.

- There are topics that are business or sector-relevant - if you have an extended supply chain with tons of outsourced suppliers, ethical supply chain will always be material for you.

- The markets speak to you - a company, in the natural course of business maintains interactions with the market that make it clear what the markets wants and where the market is dis/pleased with performance. Just ask Abercrombie and Fitch.

- The watchdogs woof at you - Check out Oxfam and its Behind the Brands ranking, or Know the Chain's food company rankings, or any of the ranking and rating analyst companies - they woof their message and any company on their radar cannot fail to hear.

So, 80% of the issues are predictably material and do not need extensive analysis paralysis to determine. Engaging stakeholders then becomes an exercise that helps determine the remaining 20%, or fine-tune the prioritization. That is, of course, if you actually engage... and if you engage with stakeholders that are relevant. Not all stakeholders are created equal and not all should be represented with equal voice. Sending out a survey may sound like fun, and 500 responses may sound robust, but if the 500 voices are a random mix, and if the survey is the only tool you use, then it's quite possible that your outcome will not reflect a differentiating set of issues for your company.

GRI Standards, the most widely used sustainability reporting framework, has in part been responsible for creating this double-edged sword. On the one hand, the notion that companies should focus on what's most important/impactful (material) makes absolute sense. On the other hand, what's the point in going through a whole process to articulate the obvious? Maya Angelou is quoted as saying: "Ask for what you want and be prepared to get it." (This works well for me at the ice cream store). GRI asked for a list of material priorities - and that's exactly what GRI is getting in GRI Standards-based reports (and G4 reports before them). But is that really what GRI wanted? A generic list of material topics that are relevant to any company? While GRI Standards also ask for disclosures about stakeholders engaged and topics raised by them, responses by companies to this disclosure are often template-ish and not necessarily correlating to the final list of material topics presented.

Let's recap - my assertion is this:

- Materiality is the crux of sustainability strategy and relevant reporting.

- Material sustainability issues are 80% predetermined and 20% differential

- The material differentiators are business or sector specific.

- Most companies take a blanket approach to materiality - everything goes in the mix and every stakeholder has equal voice. What comes out the other end is a blanket list of material topics that could apply to most companies.

- The process of determining material impacts lacks specificity and robust structure.

There should be a harmonized standard baseline of disclosures that are relevant to all companies - some will be more critical than others for different companies - but they are relevant - and material - for all. I call this Operational Materiality.

Then we should have materiality that is precise enough to differentiate - focusing on the specific aspects of a company's impacts that are a directly relevant to its business, the locations it operates in and the influence it has on society. Let's call that Precision Materiality.

I recently came across a framework which shows how this Operational Materiality part might work. It was via an interesting interview on Forbes by Christopher P Skroupa of Evan Harvey, the Global Head of Sustainability for Nasdaq. Evan Harvey explains: "Nasdaq published an ESG Reporting Guide for our European markets in March, 2017. The Guide is meant to provide an overview of the “business case” for sustainability strategy, management and performance disclosure. We identify 33 different metrics across the ESG space — the common denominators in global reporting frameworks, the most revealing and insightful measurements of company vitality — and make the justification for each. Reaction has been almost uniformly positive, and many investors have thanked us for helping to declutter a crowded data landscape." I looked at this guide, which I hadn't seen before.

The guide is primarily written to help companies traded on Nasdaq provide the information that investor markets need. The guide presents a set of 33 "Operational Materiality" metrics that all companies should report.

For each metric, there is an explanation, following the format;

- What does it measure?

- How is it measured?

- Why should it be reported?

- How does this metric correlate with other major sustainability frameworks?

- Research Notes

Now, the great thing about this guide is that is does not replicate the detail provided by other leading frameworks. It leaves the detailed metrics definition to the expert standards developers such as GRI and leaves the choice of which framework to use to the reporting companies. BUT, it elevates the most universally relevant metrics for all publicly-traded companies (and why would this not apply also to privately owned companies?) into a clear, well-worded and well-explained document that any corporate exec can understand, not just the ones with a post-doctorate in sustainable development. No jargon. Just plain, clear, straightforward language. This is a good start-point for what I call Operational Materiality.

(The Singapore Stock Exchange (SGX) also hints at this approach. While it does not strictly prescribe reporting topics, but rather adherence to a known framework, it does include guidance as follows: "In broad terms, environmental factors would include materials, energy, water, emissions, effluents and waste as well as environmental complaint mechanisms. Social factors would include health and safety, employment practices and labour rights such as collective bargaining, as well as product responsibility, anti-corruption and supplier assessments. The framework chosen is likely to have additional factors that the issuer would report on."

If we accept that the Nasdaq selected indicators together form a sensible "common denominator", then companies are freed up to focus their materiality discussions on their "precision" topics. Precision topics go beyond the common denominator baseline to the real difference the company makes in our society. Such a process would be efficient. By doing precision, engagement becomes targeted on a smaller number of issues at a deeper level. An example might be a pharma company referencing access to medicine, or a casino company referencing responsible gaming or a food company referencing nutrition or an Indian bank discussing local access to finance. Instead of debating whether water is more of a priority than energy or otherwise, you get to spend your time reviewing topics that have a differentiating impact, and you target stakeholders to engage with specifically on these topics, such as subject-matter experts, local communities, watchdogs etc. What we need is a process for determining Precision Materiality.

Let's do the litmus test. I randomly picked a few reports that use GRI Standards (selected using the GRI Sustainability Disclosure Database).

CapitaLand 2016 Global Sustainability Report: The "critical" material topics could easily be part of a common denominator of Operational Materiality. "Stakeholder engagement" has not been defined by GRI as an impact - it is a principle and process - but there's no rule to say that it couldn't be material, if the process of engaging stakeholders actually delivers an impact in society as well as being necessary to understand stakeholder perspectives. This could be precision. In the moderate and emerging section, building materials and construction waste are hints of business specific areas and could be precisionally material.

Fauji Fertilizer Company Corporate Sustainability Report 2016: Top-right quadrant topics listed are all Operational Materiality with the exception of Farmer Advisory which is definitely business-specific for agri companies. The other quadrants of the matrix are also fairly Operational. I might have expected to see something related to sustainable agriculture or groundwater contamination as material for a company in the fertilizer industry.

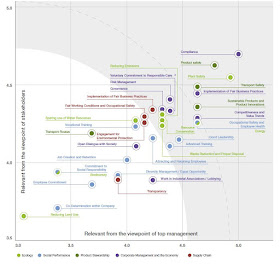

Hershey 2016 Corporate Responsibility Report: Wow. So many issues plotted in such detail. How long did THAT take? The red blobs indicate the most material priorities. "Product Ingredients and Transparency" is a clear precision topic for the food business, as are "Consumer Wellness", and "Food Safety". "Global competitiveness" is matched by Hershey to GRI Standard Anti-Competitive Behavior and is therefore operational not precision. "Supply Chain Sourcing" is also highly relevant to a food company - which includes, according to Hershey, "topics related to supplier management, supply chain transparency, sustainable

and ethical sourcing, and practices to ensure supply chain continuity. This issue

also includes our agricultural sourcing practices and support for farmers." So, in a precision matrix, where all the operational priorities are removed, Supply Chain Sourcing could probably become two or even three precision issues - Sustainable Raw Materials, Agricultural Practices and Supplier Management. Hershey's report covers these topics in detail.

Target 2016 Corporate Responsibility Report: Operational topics in the main, though "Better Products" and "Better Services and Experiences" are precision topics expressed in a not-very precise way. What does "better" mean? And does this refer to all products? All services? All experiences? "Resilient and Vibrant Communities" could also be precision, if it's more specific than general community contribution and employee volunteering. "Forest" is an interesting one - Target has a new Forest Products Policy - this could well be precisionally material as well. So, if you strip off the Operational Materiality from this list, you are left with a much shorter, focused, precise list that differentiates Target and its business. Together with operational disclosures, that would make for a clearer focus and strong presentation of materiality and reporting.

Wacker 2015/2016 Sustainability Report: There are 32 dots on this matrix (3 fewer than the Hershey matrix). Compliance, Product Safety and Plant Safety stand out as being the most significant topics. Compliance doesn't feature in the Nasdaq 33 metrics explicitly, and probably that's an omission. Every company must be compliant, that's a basic prerequisite for all sustainability initiatives and performance. However, stakeholders can benefit from understanding processes the company uses to ensure compliance, train its people and the outcomes of compliance (or non-compliance). I would call this Operational Materiality and include it as metric number 34. Plant Safety is operational. Product Safety is precision - in this case, it relates to chemical products where safety may be critical. As for the rest, there is not much that's not operational.

So, in this very brief review, we can see that just a fraction of the material issues are truly material in a very specific sense. Most of the issues labeled "material" are direct impact accountability as defined by 33 metrics - or a few more if required. Why spend so much time debating things that we all know to be a given? How many more hours will we waste moving dots around on a matrix? Yes, I hear you saying that some companies may not have as big an impact on energy, water, waste or other areas and therefore these issues are not universally material. I disagree. I think every company of a certain size must have accountability for its resource consumption, for its people management and for its governance practices and should report performance. Where companies have a greater impact in these areas, their disclosure can be more extensive.

I think there is an opportunity to simplify and harmonize sustainability disclosures in this way and use a standard set of fundamental, universally relevant operational disclosures to form the basis of sustainability reporting. The Nasdaq guide is based on recommendations from the World Federation of Exchanges (WFE) so we know this would resonate with an investor audience and be a good core for inclusion in integrated reporting. Beyond this, Precision Materiality would enable us to understand the company specific impacts, the area where added value is generated and/or where specific risks are managed.

In considering the next evolution of GRI Standards, in particular the Core / Comprehensive options, which are not terribly helpful, GRI might consider encouraging reporters to report all Operational Material Metrics (with policies, goals and targets etc in line with current GRI standards) as the GRI Standards Baseline Material Reporting Option. Each company would report on all of these metrics, using the relevant individual GRI Standards and the General Disclosures (GRI 102) to frame their reporting as now. In addition, companies would select additional business/company/sector specific topics using input from internal and external expert stakeholders, to disclose on precision material issues as the GRI Standards Advanced Material Reporting Option. In this way, companies won't be able to hide behind a materiality matrix filled with things that are relevant to everybody, but will need to elevate their focus to the things that are relevant to them and their specific stakeholders.

Phew. That turned out to be rather a long ramble that I hadn't intended. I haven't mentioned things like impact assessments and outcomes reporting - or even all those capitals that it's so sexy to talk about these days - more on these on another sunny day - it's all relevant to materiality. But in the meantime, this could be a way of demystifying of black-box materiality to satisfy multiple stakeholders. Wondering if anyone thinks it's too much and I need a vacation? (preferably one where there is lots of ice cream)

elaine cohen, CSR Consultant, Sustainability Reporter, former HR Professional, Trust Across America 2017 Lifetime Achievement Award honoree, Ice Cream Addict, Author of Understanding G4: the Concise Guide to Next Generation Sustainability Reporting AND Sustainability Reporting for SMEs: Competitive Advantage Through Transparency AND CSR for HR: A necessary partnership for advancing responsible business practices . Contact me via Twitter (@elainecohen) or via my business website www.b-yond.biz (Beyond Business Ltd, an inspired CSR consulting and Sustainability Reporting firm). Need help writing your first / next Sustainability Report? Contact elaine: info@b-yond.biz

(The Singapore Stock Exchange (SGX) also hints at this approach. While it does not strictly prescribe reporting topics, but rather adherence to a known framework, it does include guidance as follows: "In broad terms, environmental factors would include materials, energy, water, emissions, effluents and waste as well as environmental complaint mechanisms. Social factors would include health and safety, employment practices and labour rights such as collective bargaining, as well as product responsibility, anti-corruption and supplier assessments. The framework chosen is likely to have additional factors that the issuer would report on."

If we accept that the Nasdaq selected indicators together form a sensible "common denominator", then companies are freed up to focus their materiality discussions on their "precision" topics. Precision topics go beyond the common denominator baseline to the real difference the company makes in our society. Such a process would be efficient. By doing precision, engagement becomes targeted on a smaller number of issues at a deeper level. An example might be a pharma company referencing access to medicine, or a casino company referencing responsible gaming or a food company referencing nutrition or an Indian bank discussing local access to finance. Instead of debating whether water is more of a priority than energy or otherwise, you get to spend your time reviewing topics that have a differentiating impact, and you target stakeholders to engage with specifically on these topics, such as subject-matter experts, local communities, watchdogs etc. What we need is a process for determining Precision Materiality.

Let's do the litmus test. I randomly picked a few reports that use GRI Standards (selected using the GRI Sustainability Disclosure Database).

CapitaLand 2016 Global Sustainability Report: The "critical" material topics could easily be part of a common denominator of Operational Materiality. "Stakeholder engagement" has not been defined by GRI as an impact - it is a principle and process - but there's no rule to say that it couldn't be material, if the process of engaging stakeholders actually delivers an impact in society as well as being necessary to understand stakeholder perspectives. This could be precision. In the moderate and emerging section, building materials and construction waste are hints of business specific areas and could be precisionally material.

Fauji Fertilizer Company Corporate Sustainability Report 2016: Top-right quadrant topics listed are all Operational Materiality with the exception of Farmer Advisory which is definitely business-specific for agri companies. The other quadrants of the matrix are also fairly Operational. I might have expected to see something related to sustainable agriculture or groundwater contamination as material for a company in the fertilizer industry.

Target 2016 Corporate Responsibility Report: Operational topics in the main, though "Better Products" and "Better Services and Experiences" are precision topics expressed in a not-very precise way. What does "better" mean? And does this refer to all products? All services? All experiences? "Resilient and Vibrant Communities" could also be precision, if it's more specific than general community contribution and employee volunteering. "Forest" is an interesting one - Target has a new Forest Products Policy - this could well be precisionally material as well. So, if you strip off the Operational Materiality from this list, you are left with a much shorter, focused, precise list that differentiates Target and its business. Together with operational disclosures, that would make for a clearer focus and strong presentation of materiality and reporting.

Wacker 2015/2016 Sustainability Report: There are 32 dots on this matrix (3 fewer than the Hershey matrix). Compliance, Product Safety and Plant Safety stand out as being the most significant topics. Compliance doesn't feature in the Nasdaq 33 metrics explicitly, and probably that's an omission. Every company must be compliant, that's a basic prerequisite for all sustainability initiatives and performance. However, stakeholders can benefit from understanding processes the company uses to ensure compliance, train its people and the outcomes of compliance (or non-compliance). I would call this Operational Materiality and include it as metric number 34. Plant Safety is operational. Product Safety is precision - in this case, it relates to chemical products where safety may be critical. As for the rest, there is not much that's not operational.

So, in this very brief review, we can see that just a fraction of the material issues are truly material in a very specific sense. Most of the issues labeled "material" are direct impact accountability as defined by 33 metrics - or a few more if required. Why spend so much time debating things that we all know to be a given? How many more hours will we waste moving dots around on a matrix? Yes, I hear you saying that some companies may not have as big an impact on energy, water, waste or other areas and therefore these issues are not universally material. I disagree. I think every company of a certain size must have accountability for its resource consumption, for its people management and for its governance practices and should report performance. Where companies have a greater impact in these areas, their disclosure can be more extensive.

I think there is an opportunity to simplify and harmonize sustainability disclosures in this way and use a standard set of fundamental, universally relevant operational disclosures to form the basis of sustainability reporting. The Nasdaq guide is based on recommendations from the World Federation of Exchanges (WFE) so we know this would resonate with an investor audience and be a good core for inclusion in integrated reporting. Beyond this, Precision Materiality would enable us to understand the company specific impacts, the area where added value is generated and/or where specific risks are managed.

In considering the next evolution of GRI Standards, in particular the Core / Comprehensive options, which are not terribly helpful, GRI might consider encouraging reporters to report all Operational Material Metrics (with policies, goals and targets etc in line with current GRI standards) as the GRI Standards Baseline Material Reporting Option. Each company would report on all of these metrics, using the relevant individual GRI Standards and the General Disclosures (GRI 102) to frame their reporting as now. In addition, companies would select additional business/company/sector specific topics using input from internal and external expert stakeholders, to disclose on precision material issues as the GRI Standards Advanced Material Reporting Option. In this way, companies won't be able to hide behind a materiality matrix filled with things that are relevant to everybody, but will need to elevate their focus to the things that are relevant to them and their specific stakeholders.

Phew. That turned out to be rather a long ramble that I hadn't intended. I haven't mentioned things like impact assessments and outcomes reporting - or even all those capitals that it's so sexy to talk about these days - more on these on another sunny day - it's all relevant to materiality. But in the meantime, this could be a way of demystifying of black-box materiality to satisfy multiple stakeholders. Wondering if anyone thinks it's too much and I need a vacation? (preferably one where there is lots of ice cream)

elaine cohen, CSR Consultant, Sustainability Reporter, former HR Professional, Trust Across America 2017 Lifetime Achievement Award honoree, Ice Cream Addict, Author of Understanding G4: the Concise Guide to Next Generation Sustainability Reporting AND Sustainability Reporting for SMEs: Competitive Advantage Through Transparency AND CSR for HR: A necessary partnership for advancing responsible business practices . Contact me via Twitter (@elainecohen) or via my business website www.b-yond.biz (Beyond Business Ltd, an inspired CSR consulting and Sustainability Reporting firm). Need help writing your first / next Sustainability Report? Contact elaine: info@b-yond.biz

No comments:

Post a Comment