For too long, governance has been a grudging afterthought in sustainability disclosure. It’s probably the most boring part of any Sustainability Report. Like gruellingly yawnful. More often than not, it’s selective copy/paste from the Annual Report, with links to the full report. Occasionally, you get a more compelling disclosure from a company that actually injects some passion into the governance arena. You might be forgiven for thinking that the trend of ESG reporting might actually indicate that governance disclosures would be more extensive than in plain sustainability reporting. Not so. In most cases, the governance elements are sparse. Most ESG Reports should be called “ES and a little bit of G Report” or even “ES and hardly any G Report”.

Not surprising then that the forthcoming fifth

Asia Sustainability Reporting Summit, always at the cutting edge of tough sustainability topics, on December 9 and 10 (virtual), will focus on

Spicing up the G in ESG. Two half-days of learning and lively debate, with a global speaker line-up and your regular co-chair team of Rajesh Chhabara and Elaine Cohen (me 😊). We will be delighted to hear from

Helle Bank Jorgensen, CEO of Competent Boards, the Board and Business Professionals ESG certification program,

Judy Kuszewski, CEO of Sancroft and Chair of GRI’s GSSB (Global Sustainability Standards Board),

Rajeev Peshawaria, CEO of Stewardship Asia Centre, Singapore as well as from several senior leaders and governance specialists in Asia. See the speaker line-up so far

here.

As many of you will have noticed, the new

GRI Universal Standards published last month expand the governance disclosures required for reporting companies to remain In Accordance with GRI Standards. I covered the changes to governance disclosures when the Exposure Draft was published back in July 2020 in this post:

GRI Governance Galore.

Let’s recap:

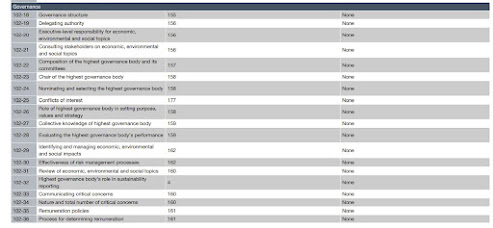

In the current GRI Standards, at Core level, all you need to do is report Disclosure 102-18 covering governance structure and Board Committees, including those with responsibility for economic, environment and social topics.

“The reporting organization shall report the following information:

• Governance structure of the organization, including committees of the highest governance body.

• Committees responsible for decision-making on economic, environmental, and social topics.”

With the elimination of the Core and Comprehensive options with the new Universal Standards, companies will be required to disclose ALL governance disclosures in order to be In Accordance.

Most Core option reporting companies report 102-18 minimalistically. The other non-Core governance disclosures – all 21 of them – are mandatory for companies reporting In Accordance at the Comprehensive level – around 20% of reporters according to GRI data. Conclusion: When the Universal Standards kick in in January 2023, 80% of those currently In Accordance at Core level will have to up their game.

My personal view is that it’s rather overkill and that required disclosures are nauseatingly detailed and go beyond the specific elements of corporate governance that are not addressed by other corporate disclosures. After all, sustainability reporting has a unique purpose. It’s not simply a place to repeat what you have already reported elsewhere. I’d have preferred to see a middle ground – more than now but less than new – as well as a requirement to report changes in (sustainability-related) corporate governance that have occurred in the reporting year. Most of the (old and new) governance disclosure requirements are evergreen policy and approaches, rather than reporting on what’s happened or what’s planned.

There are 13 governance disclosures in the new Universal Standards (compared to 22 in the current standards) But don’t be fooled. This reduction in the number of separate disclosure items is the result of combining several current disclosures into single disclosures in the Universal Standards. In fact, little has changed, except reordering and tidying up of the language. Companies reporting GRI Comprehensive option (and reporting in full) will not be challenged by the new Universal Standards on governance. Companies reporting Core may well be.

Here’s my summary of the new governance disclosures in the updated Universal Standards:

My shorthand:

- Current GRI General Disclosures (102 series): GD2016

- New Universal Standards: UD2021

- Board of Directors (highest governance body): BOD

Disclosure 2-9 Governance structure and composition: This is the same as 102-18 and 102-22 combined. But the combinations now means reporters must add six sub-clauses that require details of composition of the BOD AND its committees according to various parameters including gender, stakeholder representation, under-represented social groups, competencies relating to the organizations impacts. Oh my, this is almost report all in itself.

Disclosure 2-10 Nomination and selection of the highest governance body: Description of how BOD and committee members are nominated and selected, including diversity and other considerations. Minor wording changes from GD2016.

Disclosure 2-11 Chair of the highest governance body: UD2021 includes the requirement to explain, if the chair and the senior exec are one and the same, the how conflicts of interest are mitigated. Split personalities is not an acceptable response (I assume).

Disclosure 2-12 Role of the highest governance body: This UD2020 requirement combines five GD2016 disclosures (102-21,102-26,102-29, 102-30 102-31) and relates to the BOD role in setting purpose, values, mission and strategy relating to sustainable development and overseeing due diligence regarding management of impacts. Due diligence has snuck into UD2021 quite a lot so you had better start integrating due diligence wording into your reporting. Quite a lot.

Disclosure 2-13 Delegation of responsibility for managing impacts: This UD2021 requirement combines two GD2016 disclosures (102-19, 102-20). Companies often report this as the sustainability management structure, or sustainability governance.

Disclosure 2-14 Role of the highest governance body in sustainability reporting: This replaces GD2016 102-32 with a report or explain requirement i.e., if the BOD does not approve the report and material topics, explain the reason. Lack of interest, time, energy, ability to read or watching Grey’s Anatomy are not trust-building reasons.

Disclosure 2-15 Conflicts of interest: This replaces GD2016 102-25 with slightly revised language and covers prevention, mitigation and disclosure to stakeholders of conflicts of interest.

Disclosure 2-16 Communication of critical concerns: This UD2021 requirement combines two GD2016 disclosures (102-33,102-34) with slightly revised language. It includes reporting the total number and the nature of critical concerns that were communicated to the highest governance body during the reporting period. Just so that the BOD can’t say they didn’t know, right?

Disclosure 2-17 Collective knowledge of the highest governance body: Replaces 102-27 and requires reporting report measures taken to advance the collective knowledge, skills, and experience of the highest governance body on sustainable development. Reading their own company’s sustainability report might be a good start.

Disclosure 2-18 Evaluation of the performance of the highest governance body: Replaces GD2016 102-28 and covers the BOD’s evaluation of its performance in overseeing the management of the organization’s impacts on the economy, environment, and people.

Disclosure 2-19 Remuneration policies: Replaces 102-35 with little change. This is the place to show how the remuneration of your BOD actually aligns with your sustainability objectives.

Disclosure 2-20 Process to determine remuneration: This UD2021 disclosure combines 102-36 and 102-37 and covers the process of designing BOD remuneration policies and who is involved and stakeholder voting on remuneration.

Disclosure 2-21 Annual total compensation ratio: This UD2021 disclosure combines 102-38 and 102-39 and requires reporting of the ratio of the annual total compensation for the organization’s highest-paid individual to the median annual total compensation for all employees and the percentage increase of same to the median percentage increase of same for all employees. This is a much simplified version of former requirements which referenced not only the top dog but also the top dogs in each country of significant operations.

Now for some examples:

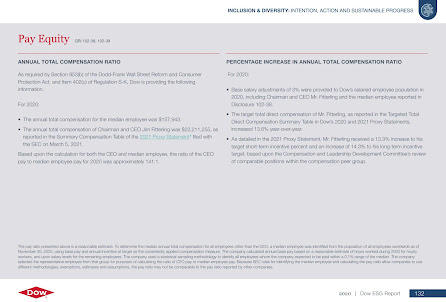

Dow Corporation 2020 ESG Report

This is one of the few reports that applies the Comprehensive option of the GRI Standards. Dow reports on each governance disclosure with due attention and completeness in the body of the report – not sliced and diced from different publications.

For example, current GRI 102-22, soon to be Disclosure 2-9, includes detailed composition of the Board of Directors by age, role, experience and expertise. There are even headshots for good measure.

Pay ratios, one of the more sensitive elements

of sustainability reporting, is also clearly reported.

Infosys ESG 2020-2021 Data Book

Infosys also reports GRI Comprehensive option

and the governance disclosures are partly in the ESG Report, partly in the

separate ESG Data Book and partly in the Annual Report.

The Annual Report includes a 40-page Governance

Report which is incredibly detailed. It took me quite some time to locate one

or two of the specific GRI-based disclosures, but I got there in the end.

Mostly, it was easy, even if it meant straddling three different documents.

Hankook Tire 2021 ESG Report

Hankook always delivers detailed, clear and

meticulous reports, using the GRI Comprehensive option. This is the only company

I have observed actually publishing a set of governance targets in its three-page

governance coverage in its ESG report.

I looked at more than 100 reports from global, large,

small and unlisted companies in preparing this post to see if I could find a

really exciting or impressive disclosure on corporate governance. Nada. There

are some that are nicely designed with graphs and pie charts, a few with Board

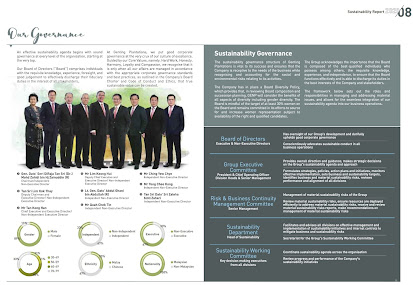

photos, a few with tables and charts. This one from Genting Plantations Berhad

is a little more pleasing to the eye than plain words on a page.

Most governance disclosures remain general, minimal and uninspiring. Going for G in ESG will require a

step change in transparency for many companies. Spicing up the G will require a step change in thinking. I foresee a global shortage of ice cream as companies

struggle to get more transparent on governance. Everything is better with ice cream.

elaine cohen, CSR consultant, Sustainability Reporter, HR Professional, Ice Cream Addict. Owner/Manager of Beyond Business Ltd, an inspired Sustainability Strategy and Reporting firm having supported 119 client reports to date; author of three books and several chapters on Sustainability Reporting and the Human Resources connection to CSR; frequent chair and speaker at sustainability events and judge in several sustainability awards programs each year. Contact me via Twitter , LinkedIn or via Beyond Business

No comments:

Post a Comment