So, since my last post broke the sound barrier with hundreds of reactions which mainly expressed support for the notion that collaboration rather than confrontation wouldn't be such a bad thing, I will delve a little deeper into one aspect of The Great GRI-SASB Showdown which didn't receive that much airtime in the multiple debates about mandatory or voluntary ESG disclosure. It's the question of specificity. Dr Madelyn Antoncic, SASB Chief Executive, made this point:

"SASB’s unique approach is well aligned with growing consensus among market participants that in order to integrate ESG matters into governance, strategy, risk management and performance monitoring, consistent with the TCFD recommendations, sustainability must be viewed on an industry specific level........ Indeed in order for any approach for corporate sustainability to be useful, it must address idiosyncratic, not systemic, risks. In other words, it must address not just climate change but climate change industry specific manifestations."

Now, I agree with this up to a point. I agree that business is done in industries and sectors, and each has their own specific material impacts. Having said that, business is done primarily by companies, and each company is unique in structure, geography, size, strategy, leadership etc., which means that its material impacts are also unique. So using pre-fab materiality à la SASB may well serve as a safety net to ensure relevant topics by industry are not overlooked, but it may not serve as a comprehensive basis for disclosure for every company in that industry. It also could lead to cutting corners where pre-fab materiality is blindly accepted without due process.

Nonetheless, SASB has done what GRI failed to do. Sector-based disclosures never reached the top of GRI's to-do list. In fact, I wrote about this back in 2013, in a post entitled "Will SASB make G4 redundant?" where I looked at the implications of the new SASB Standards on a specific sector basis. My closing line in that post is actually no less relevant today than it was then: ".....we perhaps ought to remind ourselves what Sustainability Reporting was designed to do in the first place. Account for company impacts on all stakeholders. Both GRI and SASB have an important contribution, I feel. The shame is that both appear to live on different planets, while the companies that are reporting are all on the same planet, and, more importantly, we are too!" Plus ça change.....

While SASB has developed standards for 77 industries in 11 sectors, GRI has 10 sector disclosures. There are differences in the approach to both - in fact, what GRI calls a sector, SASB mainly calls an industry. Oh dear, and I thought this was going to be easy....

I decided to see if I could substantiate the intuitive remarks I made in my last post: "Instead of debating which one is less perfect, whether they should be mandated or not and which definition of materiality should apply, GRI and SASB should roll up their sleeves and get down to some serious work with companies and with each other to help drive better implementation of sustainable development practices and disclosure. If we do nothing more than ensure existing standards are fully adopted by all companies, consistently, auditably and comprehensively, perhaps with a few tweaks here and there, we will have done a lot." In other words, let's work together with what we have and make it work. At some point, you just gotta stop checking if the oven works and make a start on the cooking.

There is a small number of companies who use SASB Standards. Not quite enough yet to consider whether this enables sector comparability or even use of similar standards, but enough for me to handpick a few reports that cover both. I decided to check a few things out:

(1) Are SASB Standards really a useful tool? To what extent is there more information than that required by a GRI report which is well prepared? In checking the delta when reporting both SASB and GRI, what value does sector-specific SASB add over and above what is already in GRI standards?

(2) What does sector specificity actually add? Is there a meaningful level of specificity that makes it easy for companies to recognize themselves in the sector?

(3) Who needs to budge to turn this into one Standard that's useful for all? Haha. No-one wants to budge. But maybe they should.

I'll start with Bloomberg. With Bloomberg putting all their weight behind the development of the SASB Standards, it's clear that they would use them, even if as a privately held company, Bloomberg is not required to go the full Monty.

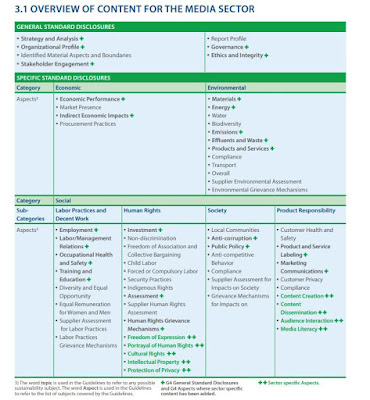

Bloomberg's 2018 Impact Report was prepared in accordance with (1) GRI Standards Comprehensive Option (including the Media Sector Disclosures) (2) SASB Standards (3) FSB Task Force on Climate-related Financial Disclosures (TCFD) guidelines and (4) "select content from CDP". That's four reporting frameworks. Convergence, anyone?

Supplementing this report, Bloomberg publishes a GRI Content Index (including the Media Sector Disclosures) and a SASB Disclosure. The SASB disclosure includes metrics from three separate SASB Standards:

SASB Standards are all standalone. So, when Bloomberg decides to report against three SASB Standards, it is actually duplicating several pieces of information. For example, you can find data on workforce diversity included three times in the same Bloomberg SASB disclosure document - one for each of the three SASB Standards that Bloomberg identified as relevant to their business.

And the funny thing is, that all this data is reported as well already in Bloomberg's GRI Content Index:

I worked through every single Bloomberg SASB disclosure against all three SASB Standards to try to establish the delta. I found that there is extremely little in the SASB disclosures that is not already reported in the GRI Content Index, or would have been reported if the GRI Content Index were applied in full. Environmental data... it's in both; data privacy - it's in both; data security - it's in both - although there are a few metrics that SASB includes that are not in GRI. On the topic of employment, SASB asks for employee engagement measures (that GRI does not specifically cover). All in all, it would take very little to combine these GRI and SASB Standards to achieve sector-specificity with no duplication and enable relevance for all stakeholders including investors.

Here's another report. Apache Corporation 2018 Sustainability Report

Apache's report follows (1) GRI Standards, Core Option (2) Oil and Gas Industry Guidance on Voluntary Sustainability Reporting (2015) developed by IPIECA (3) SASB’s Oil and Gas Exploration and Production Standard and (4) the Disclosing the Facts framework which is an annual investor scorecard ranking of the 30 largest oil and gas companies engaged in hydraulic fracturing.

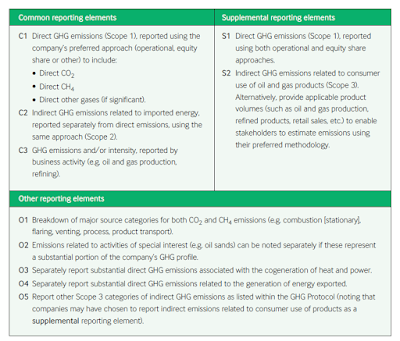

Again, I analyzed the SASB disclosure to assess if it includes more than is delivered by a regular GRI-based Sustainability Report. Note that, in this case, Apache does not use the GRI Oil and Gas Sector Disclosure, which, as with the media sector, integrates disclosures throughout the Standard and adds sector-specific additional topics.

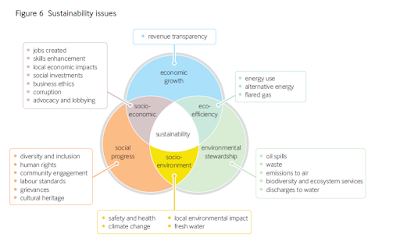

So, what about the delta? For several metrics, such as GHG emissions, biodiversity impacts, community relations, and health and safety etc., there is no meaningful difference between the Standards. In others, there are differences. For example, on the topic of indigenous peoples: GRI focuses on violations of indigenous rights in the main GRI Standard, and on disputes in the additional sector disclosure:

SASB focuses on operations in proximity to indigenous lands and engagement processes.

Apache does not report these indicators, neither GRI nor SASB. Interestingly, APACHE does report against an IPIECA indicator relating to indigenous peoples, with a Statement on Indigenous Peoples representing Apache's approach.

So, while Apache has made significant efforts to deliver high-quality transparency, it is clear that the multiple standards and frameworks cause duplication and fragmentation of reporting requirements. However, Apache reports neither Standard in full, disclosing against 13 of the 27 metrics in the SASB Oil and Gas Standard, and 17 of the 33 Topic Specific Standards of GRI and none of the sector-specific topics. The SASB Standard offers some fine-tuning of disclosures for this industry, but nothing that is monumentally significant versus a fully reported GRI Standards-based disclosure.

One more? Let's try a different sector. Food. I LOVE food (especially ice cream).

Kellogg's 2018-2019 Corporate Responsibility Report also uses multiple sustainability disclosure frameworks:

Should we count that as six frameworks?

Here again, this company has worked hard to address the multiple reporting demands of different frameworks and organize disclosures in the least confusing way for stakeholders. Not an easy task to avoid the duplication and fragmentation that we have already seen in the two reports above.

Again, my focus here is on the delta between SASB Standards requirements and GRI. In this sector, there are some significant differences. For example:

Food safety: This is material for Kellogg's, and also highlighted in the GRI Food Sector Disclosures, SASB includes two indicators that link to external audit by the Global Food Safety Initiative (GFSI) GRI on the other hand references external standards certified by an independent third party according to internationally recognized food safety management system standards, leaving companies to choose which certifications.

Food waste: This is noted as material for Kellogg's but appears neither in the GRI Standards nor in the SASB Standard.

Climate change: This is not included in SASB Standards for this sector. Energy management is included, but not climate change impacts. As Kellogg's has noted climate change as material, then GRI Standards requires disclosure on climate change impacts. I find it hard to understand how investors assessing a company such as Kellogg's would not be interested in climate change data.

Diversity and inclusion: This is stated as material for Kellogg's but is not included in the SASB Food Processing Sector Standard. It is part of GRI Standards.

Packaging lifecycle management: This is included in the SASB Standard and is a relevant addition for this sector. It is not included in GRI Standards (beyond regular disclosures about waste) although Kellogg's CR Report contains information about the sustainability of its packaging and lifecycle impacts.

Animal Welfare: The GRI Food Processing Sector disclosure is the only standard that points this out specifically. The SASB standard does not address this and Kellogg's maintain it is not material to their business.

Across both the SASB and the GRI Food Processing Sector Standards, and Kellogg's own list of material topics, there is a significant degree of overlap, but also some areas of difference. Does the SASB Standard add much? In this sector, the metrics are a little more industry-focused though it strikes me as odd that there are no SASB metrics relating to people, labor or human rights.

Back to my three questions:

(1) Are SASB Standards really a useful tool?

(2) What does sector specificity actually add?

(3) Who needs to budge to turn this into one Standard that's useful for all?

And my three answers:

(1) I cannot speak for the investor community, for whom SASB standards were devised. If the idea was that all the topics in the SASB Standards are "financially" material, then it's rather odd that very few of the SASB metrics I have seen actually correlate to any sort of financial measure. My observation is that where a company reports GRI in full, including any available sector disclosures, the additional disclosures required by SASB may not add a lot. For a company not using GRI, and using SASB for sustainability disclosures in its annual report, then it may not be enough. Having said that, the overview of what's most important by industry is a useful reference for any company conducting a materiality assessment.

(2) Sector specificity is a worthy pursuit, especially when companies are not rigorous in their materiality assessments. Kellogg's, for example, presents what I feel is a balanced and representative set of material topics, covering both the operational and purpose-driven aspects of its business. Apache's material topics are more generic, so the SASB Standard could be a useful safety net. However, in this case, as is the case in several other sectors, there is another reporting framework developed by the industry itself, IPIECA which tends to address the sector-specific requirements.

(3) I think both GRI and SASB need to budge. As can be seen from just 3 examples, reporting is fragmented, duplicated and yes, confusing. Just working out who reports what against which Standards was a nightmare. All three companies made valiant efforts to navigate these frameworks and deliver robust disclosures. We should not let the question of financial materiality divert us from the real questions of who should report what. There is room to develop a set of jointly-owned GRI-SASB Standards that would include (1) a core of disclosures and metrics on universally critical sustainability topics that every company should report, material or otherwise (2) a menu of core sector specific disclosures that all companies in a particular industry should report (3) a menu of optional metrics and indicators that companies can disclose in addition, if they or their stakeholders define them as material. What's important here is not only what to report but how to report, that is, by prescribing the methodologies required for each metric reported. That would enable the rigor and comparability that SASB maintains is so lacking. And in each industry, the industry associations, such as IPIECA, have an important role to play as well.

Ultimately, I think we have everything we need - except a spirit of collaboration. Combining the best of GRI, SASB and industry-specific experts can be an exercise in cooperation, not reinvention. By working together, we can totally simplify the landscape and make it much easier for reporters to report and users to use the information. Why is this such a big deal? Why is it so contentious?

But that's only the first step. The second step is doing more to encourage companies to fully implement these simplified reporting Standards in a consistent and auditable way. I don't mean through external assurance but through internal rigor and accountability. Both GRI and SASB are far too eager to hype up the numbers of how many companies are using their Standards. Neither is prepared to really buckle down and assess the way the Standards are being implemented or call out companies that are doing a pick'n'mix job of reporting what's easy or available or irrelevant.

The GRI-SASB Game of Thrones Showdown I witnessed at the Asia Sustainability Reporting Summit earlier this month did not offer much hope of collaboration. Apparently, the comfort zone is exactly where they are. Unfortunately, it's a very uncomfort zone for everyone having to deal with the fallout.

elaine cohen, CSR consultant, Sustainability Reporter, HR Professional, Ice Cream Addict. Owner/Manager of Beyond Business Ltd, an inspired Sustainability Strategy and Reporting firm having supported 100 client reports to date; author of three books and several chapters on Sustainability Reporting and the Human Resources connection to CSR; frequent chair and speaker at sustainability events and judge in several sustainability awards programs each year. Contact me via Twitter , LinkedIn or via Beyond Business

Nonetheless, SASB has done what GRI failed to do. Sector-based disclosures never reached the top of GRI's to-do list. In fact, I wrote about this back in 2013, in a post entitled "Will SASB make G4 redundant?" where I looked at the implications of the new SASB Standards on a specific sector basis. My closing line in that post is actually no less relevant today than it was then: ".....we perhaps ought to remind ourselves what Sustainability Reporting was designed to do in the first place. Account for company impacts on all stakeholders. Both GRI and SASB have an important contribution, I feel. The shame is that both appear to live on different planets, while the companies that are reporting are all on the same planet, and, more importantly, we are too!" Plus ça change.....

While SASB has developed standards for 77 industries in 11 sectors, GRI has 10 sector disclosures. There are differences in the approach to both - in fact, what GRI calls a sector, SASB mainly calls an industry. Oh dear, and I thought this was going to be easy....

I decided to see if I could substantiate the intuitive remarks I made in my last post: "Instead of debating which one is less perfect, whether they should be mandated or not and which definition of materiality should apply, GRI and SASB should roll up their sleeves and get down to some serious work with companies and with each other to help drive better implementation of sustainable development practices and disclosure. If we do nothing more than ensure existing standards are fully adopted by all companies, consistently, auditably and comprehensively, perhaps with a few tweaks here and there, we will have done a lot." In other words, let's work together with what we have and make it work. At some point, you just gotta stop checking if the oven works and make a start on the cooking.

There is a small number of companies who use SASB Standards. Not quite enough yet to consider whether this enables sector comparability or even use of similar standards, but enough for me to handpick a few reports that cover both. I decided to check a few things out:

(1) Are SASB Standards really a useful tool? To what extent is there more information than that required by a GRI report which is well prepared? In checking the delta when reporting both SASB and GRI, what value does sector-specific SASB add over and above what is already in GRI standards?

(2) What does sector specificity actually add? Is there a meaningful level of specificity that makes it easy for companies to recognize themselves in the sector?

(3) Who needs to budge to turn this into one Standard that's useful for all? Haha. No-one wants to budge. But maybe they should.

I'll start with Bloomberg. With Bloomberg putting all their weight behind the development of the SASB Standards, it's clear that they would use them, even if as a privately held company, Bloomberg is not required to go the full Monty.

Bloomberg's 2018 Impact Report was prepared in accordance with (1) GRI Standards Comprehensive Option (including the Media Sector Disclosures) (2) SASB Standards (3) FSB Task Force on Climate-related Financial Disclosures (TCFD) guidelines and (4) "select content from CDP". That's four reporting frameworks. Convergence, anyone?

Supplementing this report, Bloomberg publishes a GRI Content Index (including the Media Sector Disclosures) and a SASB Disclosure. The SASB disclosure includes metrics from three separate SASB Standards:

- Internet and Media Services

- Media and Entertainment

- Professional and Commercial Services

SASB Standards are all standalone. So, when Bloomberg decides to report against three SASB Standards, it is actually duplicating several pieces of information. For example, you can find data on workforce diversity included three times in the same Bloomberg SASB disclosure document - one for each of the three SASB Standards that Bloomberg identified as relevant to their business.

And the funny thing is, that all this data is reported as well already in Bloomberg's GRI Content Index:

I worked through every single Bloomberg SASB disclosure against all three SASB Standards to try to establish the delta. I found that there is extremely little in the SASB disclosures that is not already reported in the GRI Content Index, or would have been reported if the GRI Content Index were applied in full. Environmental data... it's in both; data privacy - it's in both; data security - it's in both - although there are a few metrics that SASB includes that are not in GRI. On the topic of employment, SASB asks for employee engagement measures (that GRI does not specifically cover). All in all, it would take very little to combine these GRI and SASB Standards to achieve sector-specificity with no duplication and enable relevance for all stakeholders including investors.

Here's another report. Apache Corporation 2018 Sustainability Report

Apache's report follows (1) GRI Standards, Core Option (2) Oil and Gas Industry Guidance on Voluntary Sustainability Reporting (2015) developed by IPIECA (3) SASB’s Oil and Gas Exploration and Production Standard and (4) the Disclosing the Facts framework which is an annual investor scorecard ranking of the 30 largest oil and gas companies engaged in hydraulic fracturing.

Again, I analyzed the SASB disclosure to assess if it includes more than is delivered by a regular GRI-based Sustainability Report. Note that, in this case, Apache does not use the GRI Oil and Gas Sector Disclosure, which, as with the media sector, integrates disclosures throughout the Standard and adds sector-specific additional topics.

So, what about the delta? For several metrics, such as GHG emissions, biodiversity impacts, community relations, and health and safety etc., there is no meaningful difference between the Standards. In others, there are differences. For example, on the topic of indigenous peoples: GRI focuses on violations of indigenous rights in the main GRI Standard, and on disputes in the additional sector disclosure:

SASB focuses on operations in proximity to indigenous lands and engagement processes.

Apache does not report these indicators, neither GRI nor SASB. Interestingly, APACHE does report against an IPIECA indicator relating to indigenous peoples, with a Statement on Indigenous Peoples representing Apache's approach.

So, while Apache has made significant efforts to deliver high-quality transparency, it is clear that the multiple standards and frameworks cause duplication and fragmentation of reporting requirements. However, Apache reports neither Standard in full, disclosing against 13 of the 27 metrics in the SASB Oil and Gas Standard, and 17 of the 33 Topic Specific Standards of GRI and none of the sector-specific topics. The SASB Standard offers some fine-tuning of disclosures for this industry, but nothing that is monumentally significant versus a fully reported GRI Standards-based disclosure.

One more? Let's try a different sector. Food. I LOVE food (especially ice cream).

Kellogg's 2018-2019 Corporate Responsibility Report also uses multiple sustainability disclosure frameworks:

- GRI Standards including the Food Processing Sector Disclosures (downloadable Content Index)

- SASB Food Processing Standard (downloadable index)

- CDP Climate and Water Disclosures

- Cross-references in the GRI Index to SDGs and the UN Global Compact Principles

Should we count that as six frameworks?

Here again, this company has worked hard to address the multiple reporting demands of different frameworks and organize disclosures in the least confusing way for stakeholders. Not an easy task to avoid the duplication and fragmentation that we have already seen in the two reports above.

Again, my focus here is on the delta between SASB Standards requirements and GRI. In this sector, there are some significant differences. For example:

Food safety: This is material for Kellogg's, and also highlighted in the GRI Food Sector Disclosures, SASB includes two indicators that link to external audit by the Global Food Safety Initiative (GFSI) GRI on the other hand references external standards certified by an independent third party according to internationally recognized food safety management system standards, leaving companies to choose which certifications.

Food waste: This is noted as material for Kellogg's but appears neither in the GRI Standards nor in the SASB Standard.

Climate change: This is not included in SASB Standards for this sector. Energy management is included, but not climate change impacts. As Kellogg's has noted climate change as material, then GRI Standards requires disclosure on climate change impacts. I find it hard to understand how investors assessing a company such as Kellogg's would not be interested in climate change data.

Diversity and inclusion: This is stated as material for Kellogg's but is not included in the SASB Food Processing Sector Standard. It is part of GRI Standards.

Packaging lifecycle management: This is included in the SASB Standard and is a relevant addition for this sector. It is not included in GRI Standards (beyond regular disclosures about waste) although Kellogg's CR Report contains information about the sustainability of its packaging and lifecycle impacts.

Animal Welfare: The GRI Food Processing Sector disclosure is the only standard that points this out specifically. The SASB standard does not address this and Kellogg's maintain it is not material to their business.

Across both the SASB and the GRI Food Processing Sector Standards, and Kellogg's own list of material topics, there is a significant degree of overlap, but also some areas of difference. Does the SASB Standard add much? In this sector, the metrics are a little more industry-focused though it strikes me as odd that there are no SASB metrics relating to people, labor or human rights.

|

| Kellogg's own material topics, SASB's Food Processing Standard topics and GRI Food Processing Sector Disclosures (additional to and incorporated in the general GRI Standards) |

Back to my three questions:

(1) Are SASB Standards really a useful tool?

(2) What does sector specificity actually add?

(3) Who needs to budge to turn this into one Standard that's useful for all?

And my three answers:

(1) I cannot speak for the investor community, for whom SASB standards were devised. If the idea was that all the topics in the SASB Standards are "financially" material, then it's rather odd that very few of the SASB metrics I have seen actually correlate to any sort of financial measure. My observation is that where a company reports GRI in full, including any available sector disclosures, the additional disclosures required by SASB may not add a lot. For a company not using GRI, and using SASB for sustainability disclosures in its annual report, then it may not be enough. Having said that, the overview of what's most important by industry is a useful reference for any company conducting a materiality assessment.

(2) Sector specificity is a worthy pursuit, especially when companies are not rigorous in their materiality assessments. Kellogg's, for example, presents what I feel is a balanced and representative set of material topics, covering both the operational and purpose-driven aspects of its business. Apache's material topics are more generic, so the SASB Standard could be a useful safety net. However, in this case, as is the case in several other sectors, there is another reporting framework developed by the industry itself, IPIECA which tends to address the sector-specific requirements.

(3) I think both GRI and SASB need to budge. As can be seen from just 3 examples, reporting is fragmented, duplicated and yes, confusing. Just working out who reports what against which Standards was a nightmare. All three companies made valiant efforts to navigate these frameworks and deliver robust disclosures. We should not let the question of financial materiality divert us from the real questions of who should report what. There is room to develop a set of jointly-owned GRI-SASB Standards that would include (1) a core of disclosures and metrics on universally critical sustainability topics that every company should report, material or otherwise (2) a menu of core sector specific disclosures that all companies in a particular industry should report (3) a menu of optional metrics and indicators that companies can disclose in addition, if they or their stakeholders define them as material. What's important here is not only what to report but how to report, that is, by prescribing the methodologies required for each metric reported. That would enable the rigor and comparability that SASB maintains is so lacking. And in each industry, the industry associations, such as IPIECA, have an important role to play as well.

Ultimately, I think we have everything we need - except a spirit of collaboration. Combining the best of GRI, SASB and industry-specific experts can be an exercise in cooperation, not reinvention. By working together, we can totally simplify the landscape and make it much easier for reporters to report and users to use the information. Why is this such a big deal? Why is it so contentious?

But that's only the first step. The second step is doing more to encourage companies to fully implement these simplified reporting Standards in a consistent and auditable way. I don't mean through external assurance but through internal rigor and accountability. Both GRI and SASB are far too eager to hype up the numbers of how many companies are using their Standards. Neither is prepared to really buckle down and assess the way the Standards are being implemented or call out companies that are doing a pick'n'mix job of reporting what's easy or available or irrelevant.

The GRI-SASB Game of Thrones Showdown I witnessed at the Asia Sustainability Reporting Summit earlier this month did not offer much hope of collaboration. Apparently, the comfort zone is exactly where they are. Unfortunately, it's a very uncomfort zone for everyone having to deal with the fallout.

elaine cohen, CSR consultant, Sustainability Reporter, HR Professional, Ice Cream Addict. Owner/Manager of Beyond Business Ltd, an inspired Sustainability Strategy and Reporting firm having supported 100 client reports to date; author of three books and several chapters on Sustainability Reporting and the Human Resources connection to CSR; frequent chair and speaker at sustainability events and judge in several sustainability awards programs each year. Contact me via Twitter , LinkedIn or via Beyond Business