I wish I were an accountant. Clearly, I'd have so much time on my hands that all I would do is prepare new frameworks for sustainability metrics. I would spend my mornings dreaming up some new framework that looks just enough different from what's already out there to make it Big News, and spend my afternoons convincing everybody why it solves all their problems. Then I would make a ton of money when people are so bewildered and confused that they adopt my framework and ask me to check it over.

This was my first reaction to the new WEF publication: Measuring Stakeholder Capitalism: Towards Common Metrics and Consistent Reporting of Sustainable Value Creation which can't have helped escape your attention if you are on the sustainability circuit. (OK, I don't really wish I were an accountant. I don't think I could handle all the accountant jokes.)

I can't tell you how many clients and colleagues have asked me what I think about the WEF metrics framework, meaning, is it good or is it bad? GRI has published a diplomatic response saying they "cautiously welcome" this approach but that it doesn't go far enough. Prof. Carol Adams has also weighed in: "Once upon a time there was a glimmer of hope that accountants could save the planet. The motivation for this report is unclear and expressed differently in different parts. But it is not going to save the planet and could well do more harm than good." And no less a scathing reaction from Carlos Tornero at Responsible Investor: "As for reforming capitalism, I’m afraid the Big Four are not the best ambassadors for that."

For those who haven't yet studied the WEF paper, here's 96 pages distilled (followed by my commentary):

The proposal was developed as part of the WEF's International Business Council (IBC) and led by the Bank of America, who chairs the IBC, and the Big Four accounting firms: Deloitte, EY, PwC and KPMG. The IBC is a community of CEOs of around 140 companies, as far as I can gather, but I cannot find a list of the specific companies that are members of this group.

The objective of developing this disclosure framework was "to

identify a set of universal, material ESG metrics and recommended disclosures that could be reflected

in the mainstream annual reports of companies on a consistent basis across industry sectors

and countries. The metrics should be capable of verification and assurance, to enhance transparency

and alignment among corporations, investors and all stakeholders."

The hope is to encourage "IBC companies to begin reporting

collectively on this basis in an effort to encourage greater cooperation and alignment among existing standards as well as to catalyse progress towards

a systemic solution, such as a generally accepted international accounting standard in this respect."

And an important point: "This effort is not intended to diminish the value of the separate sustainability/ESG/impact reports, which often provide more comprehensive information at the industry- and company-specific levels, tailored to the interests of stakeholders beyond investors."

The proposed metrics are intended to be universal, industry agnostic ESG metrics/disclosures. There are two types:

Core Metrics: 21 metrics and reporting requirements. "These are primarily quantitative metrics for which information is already being reported by many firms (albeit often in different formats) or can be obtained with reasonable effort. They focus primarily on activities within an organization’s own boundaries."

Expanded metrics: 34 metrics. "The expanded metrics and disclosures encourage companies to move from reporting outputs alone to capturing the impacts of their operations on nature

and society across the full value chain, in more tangible, sophisticated ways, including the monetary

value of impacts. These tend to be less well established in existing practice and standards...They represent a more advanced way of measuring and communicating sustainable value creation, and companies are encouraged to report against them as well, when material and appropriate."

Below is an overview of the metrics (reproduced from IAS PLUS )

Governance Core Metrics include: Company purpose statement, governance overview, material topics, anti-corruption, ethical reporting mechanisms and risk management.

Expanded metrics include:

- How the company’s stated purpose is embedded in company strategies, policies and goals

- Disclosure of the material strategic economic, environmental and social milestones

- How performance criteria in the remuneration policies relate to the highest governance body’s and senior executives’ objectives for economic, environmental and social topic and details of Board and executive remuneration

- The significant issues that are the focus of the company’s participation in public policy development and lobbying

- Total amount of monetary losses as a result of legal proceedings associated with fraud, insider trading, anti-trust, anti-competitive behavior, market manipulation, malpractice or violations of other related industry laws or regulations

- How the highest governance body considers economic, environmental and social issues when overseeing major capital allocation decisions, such as expenditures, acquisitions and divestments

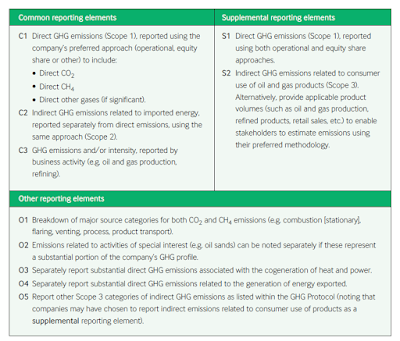

Planet Core Metrics include: GHG emissions, TCFD implementation, land use, water consumption in water stressed areas.

Expanded metrics include:

- Paris-aligned GHG emissions targets (science-based)

- Impact of GHG emissions - the estimate of the societal cost of carbon used

- Land use and ecological sensitivity

- Impact of land use and conversion

- Impact of freshwater consumption and withdrawal

- Air pollution and impact of air pollution

- Water pollution and impact of water pollution

- Single-use plastics

- Impact of solid waste disposal

- Resource circularity - potential metrics include (but are not limited to) the Circular Transition Indicators (WBCSD), indicators developed by the Ellen MacArthur Foundation and company developed metrics.

People Core Metrics include: Diversity and inclusion, pay equality, pay levels, risks of child, forced and compulsory labor, health and safety, training

Expanded metrics include:

- Mean pay gap of basic salary and remuneration of full-time relevant employees based on gender (women to men) and indicators of diversity (e.g. BAME to non-BAME) at a company level or by significant location of operation

- Ratio of the annual total compensation for the organization’s highest-paid individual in each country of significant operations to the median annual total compensation for all employees

- Discrimination and harassment incidents (#) and the total amount of monetary losses ($)

- Freedom of association and collective bargaining at risk (%)

- Human rights review, grievance impact & modern slavery (#, %) - total number and percentage of operations that have been subject to human rights reviews or human rights impact assessments, by country.

- Living wage (%) - current wages against the living wage for employees and contractors in states and localities where the company is operating.

- Monetized impacts of work-related incidents on organization (#, $)

- Employee well-being (#, %) - the number of fatalities as a result of work-related ill-health, recordable work-related ill-health injuries, and the main types of work-related ill-health for all employees and workers, and percentage of employees participating in “best practice” health and well-being programmes, and Absentee rate (AR) of all employees.

- Number of unfilled skilled positions (#, %)

- Monetized impacts of training – increased earning capacity as a result of training intervention (%, $) - investment in training as a percentage (%) of payroll and effectiveness of the training and development through increased revenue, productivity gains, employee engagement and/or internal hire rates

Prosperity Core Metrics include: Employment, economic contribution, financial investments, R&D expenditure, tax payments

Expanded metrics include:

- Infrastructure investments and services supported

- Significant indirect economic impacts - examples of significant identified indirect economic impacts of the organization, including positive and negative impacts.

- Social value generated (%) - percentage of revenue from products and services designed to deliver specific social benefits or to address specific sustainability challenges

- Vitality Index - percentage of gross revenue from product lines added in last three (or five) years calculated as the sales from products that have been launched in the past three (or five) years divided by total sales, supported by narrative that describes how the company innovates to address specific sustainability challenges.

- Total Social Investment ($) - Total Social Investment (TSI) sums up a company’s resources used for “S” in ESG efforts defined by CECP Valuation Guidance.

- Additional tax remitted - total additional global tax collected by the company on behalf of other taxpayers, including VAT and employee-related taxes that are remitted by the company on behalf of customers or employees, by category of taxes

- Total tax paid by country for significant locations

********

So, take a deep breath, and let's summarize:

First, the accountants have decided (with input via a survey from some of the IBC companies) what represents a set of universal core metrics that every company should report on - whatever their shape or size. These metrics reflect largely DIRECT IMPACTS which each company can measure, control, and improve.

Second, the framework offers an additional set of metrics that represent mainly INDIRECT IMPACTS - the ways in which the company impacts the world through its value chain.

Third, it uses metrics that largely already exist in different frameworks.. a pick'n'mix from well known and lesser known frameworks, heavily leaning on GRI and to a lesser extent on SASB. Interestingly, although CDP is cited, none of the metrics are directly taken from the CDP questionnaires.

Fourth, it incorporates some new concepts such as living wage (not new but not covered by existing frameworks), inclusion of corporate purpose (the new sexy), "vitality index" (heard of that one?), WCBSD Circular Transition Indicators, monetized impacts of training and others. Two new metrics have been invented - one for single use plastics and one for land use.

What do I think?

Although the WEF metrics-team may have tried not to reinvent the wheel, they have actually reinvented the bicycle. The proposal moves away from the GRI approach of materiality by applying a common measurement system to all companies at a fundamental level - the things any company anywhere should be taking into account in the management of its own operations. The second set of (expanded) metrics also ignores the materiality approach and prescribes a range of measurements reflecting what the WEF team feel are the most relevant universal social and environmental issues - linking their selection to SDGs. After companies have done all of this, they have the option of applying a materiality lens and adding whatever crumbs are relevant for their "other" stakeholders, i.e. not investors.

Actually, this approach has some elements of something I have been advocating for years - see my post from 2017: Materiality - from meaningless to differentiating in which I wrote:

- There should be a harmonized standard baseline of disclosures that are relevant to all companies - some will be more critical than others for different companies - but they are relevant - and material - for all. I call this Operational Materiality.

- Then we should have materiality that is precise enough to differentiate - focusing on the specific aspects of a company's impacts that are a directly relevant to its business, the locations it operates in and the influence it has on society. Let's call that Precision Materiality.

The WEF metrics partly go this route. WEF Core Metrics represent operational ESG performance. Expanded Metrics represent broader impacts - but remain any industry, and not specifically relative to what might be considered material for a specific company.

So back to the question, is it good or is it bad?

Coming just on the heels of the "standard setters' " proud declaration of how well they all fit in with each other and that no-one needs to be confused any more (and that's another (long) story 😜), here is yet another framework for ESG disclosure. I have to say that I rolled my eyes so hard that they almost stuck to my skull when I read the Press Release: “This is a unique moment in history to walk the talk and to make stakeholder capitalism measurable,” says Klaus Schwab, Founder and Executive Chairman, World Economic Forum. “Having companies accepting, not only to measure but also to report on, their environmental and social responsibility will represent a sea change in economic history.” Seriously? A unique moment in history? A sea change? Excuse me... with all due respect, where has Mr Schwab been for the past 25 years? This is not a unique moment, it's one of hundreds and hundreds (arguably regrettably) similar moments that have occurred in the past several years, with the publication of every new sustainability disclosure framework, and having companies report on their environmental and social responsibility is actually current practice for most of the large companies in the world - there may be inconsistencies, there may be gaps, but it is happening, and it has consistently been getting better.

I also had a bit of a laugh at the visual in the WEF report's final section... rainbows galore!

The conclusion is also a Call to Action to IBC members. "Given the urgency of this agenda, we invite all IBC members to declare their intention to report on these metrics and disclosures; collectively, we will present a timeline for that process at the IBC’s Winter Meeting in January 2021. Finally, we encourage the wider corporate community to join us in this collective endeavour." Watch this space, apparently. But you have time for a quick nap before January 2021.

My answer to the question, then, is that the wheels are good but the bicycle is bad.

I'll explain.

I agree with the concept of having a set of metrics that are relevant for all companies, as I have said. And the core metrics are a reasonable selection (with some exceptions - see below). BUT, why on earth did the accountants think they needed to create yet another framework? As I have said several times, we do not need new frameworks, we need consistent implementation of existing frameworks. Take materiality as a case in point. Everyone is now swooning over the new concept of dynamic materiality - which in my view is a poor compromise to enable everyone to have a seat at the table without resolving underlying issues of how materiality is determined. Instead of creating yet another way to describe what materiality is, why has no-one one come up with a fool-proof comparable auditable methodology to help companies determine what represents material impacts from a sustainability standpoint? The new iteration of the GRI Standards, that has recently been in Exposure Draft did not do this, and GRI has never done this. "GRI is the disclosure tool, we do not prescribe the methodology" said GRI. But heck, if your entire disclosure concept is based on materiality, why wouldn't you offer a methodology for how to create it? And this, in my view, has been the single biggest gap in sustainability reporting standards to date, and is the reason that so many other standards have sprung up. By asking companies to disclose material topics, without understanding or being able to reasonably audit what those material impacts are, comparability and rigor in sustainability disclosure were effectively destroyed. SASB stepped in and said, hey, we can do it. And they spent millions of hours and dollars creating sets of prescriptive metrics for different sectors, but even that doesn't do the job, as companies still select from SASB metrics based on their own, possibly arbitrary, definition of material topics.

Back to square one. Cue the accountants. Forget materiality. Everyone should be accountable for certain things in the same way. Let's cut and paste from as many existing frameworks as we can find, and call it The Enlightenment. So I think that's bad. I think it's a perpetuation of all that's wrong in the current sustainability disclosure landscape where every player is focused more on differentiating their own approach than on taking the higher view of how we can work together and build on what is and agree to make real change for the greater good. The WEFers may have pick'n'mixed from GRI, SASB, and all the rest. So what. The bicycle is new. Companies will have to learn how to ride it. Just when they were getting used to riding their current model. All we need now is for Larry Fink to send a letter to all the CEOs of companies in Blackrock's portfolio saying they must report disclose using SASB, TCFD AND the WEF metrics. Won't that be fun? So much for alignment, harmonization, simplification.

And as for the core metrics, well, they are almost all based on GRI General or Topic-specific Disclosures. Why just not direct IBC members to report those GRI metrics? What was the point of creating an entirely new framework that just recycles the current best practice? Also, why some metrics were selected and others omitted is not so clear. Waste, for example, is not included in the Planet Core Metrics. But I would have thought that waste is absolutely core for most companies. And some metrics are rather useless. For example, in the People category, under "Skills for the Future", the metrics are average number of training hours and training expenditure. This is so old school. The number of training hours or the amount you spend on training is hardly an indicator of whether you are building skills for the future. In any event, many companies are moving away from formal traditional training programs in favor of other types of personal and professional development, so training hours is becoming an increasingly incomplete measure. So, by picking and mixing, the accountants may have come up with a set of core metrics that are comparable and auditable up to a point, but, frankly, what's the value add here? Not much.

And what are metrics? Hint: Only a part of the story of a company's impacts and overall role in society. The context, the journey, the strategy, the targets, the process, the culture, the examples of practice, the insight, the accountability, the people .... all these are important in sustainability disclosure. This framework is an accounting tick-box by accountants for accountants. Something that makes sense to them because it can be quantified, stuck into categories, computed and converted into theoretical evaluations and risk assessments that may help investors know how rich they can get. Is this what sustainable development has become? A set of monetizable compartmentalized scores? This may be the story of sustainability disclosure promoting itself into obsolescence. Precisely because sustainability has been so successfully (yes, not perfectly) addressed and disclosed over the years, the money markets woke up. Now, they are trying to reframe it in ways that fit with what they know. Like the country farmer who visited the Empire State Building and asked: how many sheep does it hold? Well, not everything that glitters is gold and not everything that's a number is meaningful.

My assessment is that the WEF framework will not go mainstream as such, beyond the IBC members, if they even bother to apply it, even though the accountants will hype it.

Companies that already disclose GRI, SASB, CDP and TCFD may well find themselves hitting many of the WEF metrics in any case, so they will sort of deliver the WEF indicators by default.

If Larry Fink suddenly decides that this is the new Holy Grail, then he can probably get it without companies adding too much in the way of new disclosures. Some eager-beavers may start including a WEF index alongside all their other indices that support their reporting. What's another download, anyway? And let's not get started on the competitive scramble around Core and Expanded....can't you just see the Press Releases? "XXX company demonstrates global leadership in radical transparency in its new Sustainability / Annual Report by meeting all the requirements of the Expanded Metrics of the WEF ESG disclosure framework." Wowee.

If only the humanity could be saved by the proliferation of reporting frameworks…. 😂🤣😂 … we would all be able to spend more time trying out new ice cream flavors and enjoying days on the beach, wearing an "SDG Been There Done That" T-shirt.

Note: October 2, 2020: This post originally stated in error that there were 22 core indicators - there are 21. This has been corrected.

elaine cohen, CSR consultant, Sustainability Reporter, HR Professional, Ice Cream Addict. Owner/Manager of Beyond Business Ltd, an inspired Sustainability Strategy and Reporting firm having supported 107 client reports to date; author of three books and several chapters on Sustainability Reporting and the Human Resources connection to CSR; frequent chair and speaker at sustainability events and judge in several sustainability awards programs each year. Contact me via Twitter , LinkedIn or via Beyond Business