2023 will be another dynamo year for the reporting landscape. Alongside the development of standards and frameworks, interoperability, global baselines, materiality debates and promises of comparability, the hard work of reporting goes on and first-time, experienced and expert reporters continue to grapple with old and new disclosure challenges.

Here's a round-up of some stuff that might be helpful as the 2022-2023 reporting cycle kicks in. Some of it may be familiar to regular CSR Reporting Blog readers - I am nothing if not repetitive - I am nothing if not repetitive - haha. But, well, some things need saying twice, or fourteen times. I am nothing if not repetitive. Let's get started:

1. The More You Sweat in Peace, the Less You Bleed in Battle

This saying is attributed to many people so I can't be sure who said it first. Paraphrased for our purposes: the harder you work now at preparing for compliance, the easier it will be to comply when there's no longer a choice. I think we all know that sustainability disclosure is heading toward its legal coming of age. This includes regulatory requirements governing the content of disclosures (especially on climate and nature), the timing and formats of publication and third-party assurance. While there's always a transition period, it flies by quickly. It's well worth ensuring you know which upcoming standards are likely to affect your business, from when, and starting to put in place the necessary building blocks to meet the new demands. A selection of the most prominent changes:

GRI 2021 and updated universal standards: This one should already be in the bag for GRI reporters. The changes apply for publications from Jan 1, 2023. Not regulatory but market-driven.

CSRD: As part of the Corporate Sustainability Reporting Directive, the European EFRAG-ESRS Standards, - the first 12 of them anyway, including climate, water, biodiversity, circularity, workforce, community impacts and business conduct - were approved by the EU and will apply on a phased basis from FY2024 once ratified in EU member countries.

IFRS ISSB: The two initial proposed standards for general sustainability-related disclosures (IFRS S1) and climate-related disclosures (IFRS S2) are expected to be finalized any day soon. Implementation by law will depend on uptake in various jurisdictions. The UK has already thrown its hat in the ring.

2. Out of the Fire and into the Frying Pan

It pays to keep a level head when faced with the hype around how all the new reporting standards will make everything so much better/easier/more consistent. Agreed, there is some convergence that removes a layer of clutter and an acronym or three. IIRC, CDSB and SASB are now all one organization. But wait, the last time I looked, there is a new set of investor-focused standards called ISSB, as well as a set of SASB standards that ISSB will most likely consume or interoperabilize. There is another evolving set of European CSRD ESRS standards with its expected array of sector standards in the future. And GRI is continuing.. slowly but doggedly.. to develop its own suite of sector standards. TCFD and its nearly-newborn cousin TNFD are squarely in the mix. In addition there are stock exchange requirements around the world, including the upcoming intensification of climate disclosures for the U.S. SEC, and oh, let's not forget, the SDG framework and the politically correct imperative of public alignment. We have materiality, sustainability-related financial materiality, double materiality, dynamic materiality, none of which are applied using a consistent, clear or, in many cases, auditable methodology. Throw WEF SCM and CDP into the mix and even UNGPBHR. And how could we not mention the all-new bells-and-whistles UNGC COP with its multiple choice online questionnaire that resembles a low-grade intelligence test for reporting interns.

So what's changed? Fewer acronyms? More optimistic rhetoric? Belief in a new era of interoperability and comparability? What no-one is saying is that reporting will be no less challenging, no less complex and no more comparable in the future. Best not to get too taken up with the time you will save in this new disclosure utopia and and focus on developing robust internal processes that will ensure you tackle this complexity in the most efficient way. For example, ensure a consistent data collection process to create core datasets that can be easily sliced and diced to meet different reporting needs. As we are now in the frying pan, you'd better get better at making omelets.

3. Switch out FOMO with JOMO

Fear Of Missing Out (FOMO) is not a good basis for disclosure excellence. Following the herd may not be the right thing for your business. By focusing on what you must disclose (regulators rule ) and what you need to disclose (your impacts, your accountability, not everybody's impacts), you can travel along the reporting highway at speed and get to your destination without unnecessary baggage. This is the Joy of Missing Out (JOMO) approach. Be joyful in saying: "No, this does not add value." GRI+ISSB(SASB)/CSRD+TCFD+CDP (plus regulatory requirements in different markets) seems to be the majority-rule common sense mix moving forward. They cover the information that anyone should reasonably need to know to evaluate a company's environmental and social impacts and risks. Maybe companies should work at disclosing diligently against these frameworks and only add more metrics if there is an explicit compelling business case to do so.

4. Be a Futurist not a Historian

Sustainability reports should reflect a year of past performance (frankly, I don't need your timeline going back to when you first learned the term sustainability) but increasingly, we expect reports to predict a little of your company's future and the way it plans to navigate the sustainability challenges ahead, mitigate risks and achieve its goals. Reporting content should balance the current state of play with future plans and initiatives. What you have done is not a guarantee of what you will do, so how you are moving forward is critical for an understanding of the level of your company's commitment and sound sustainability management. Oh, and a one-liner entitled "Looking ahead" that says "continue to contribute to xyz" doesn't really cut it. If you have no plans to drive progress on material topics, you should develop some.

Here's an example found in a 2022 ESG Report, one of a series of stated goals:

Of course, there is much behind-the-scenes work that goes on in any company to maintain compliance with regulations, including anti-competition laws. Compliance is a business process that requires resources and attention and diligent management. But, for this company, anti-competitive behavior was not explicitly declared as a sustainable development material topic, and there is no discussion about anti-competitive challenges in the report itself. What's the value of a target such as this? Isn't it a bit like having a goal to brush your teeth every morning? Or a goal to walk the dog twice a day? For me, a goal is not about maintenance, unless maintaining the status quo is expected to be extra tough because of new challenges that would send you off-course if you took no action. If so, I would expect to read about the challenges and the step-change that a goal such as this is designed to deliver. Otherwise, it's a bit of a stocking filler.

5. Target Targets

I continue to be astounded that companies who declare "sustainability is in our DNA" while publishing creative and elaborate ESG strategies and attesting to intensive stakeholder engagement do not state their targets in key sustainability performance areas. Maybe they don't have any? Or maybe they are secret? Either way, lack of targets means lack of credibility. These days, when I read and review sustainability reports, I follow this path: (1) CEO letter (2) Materiality (3) Targets (4) All the rest. I look for consistency among the first three reporting elements. If there is a total disconnect, or if any of these elements are unconvincing, oops, I read all the rest with a high degree of skepticism, no matter how well-written or how beautifully designed it is. Companies that are serious about sustainability set SMART targets: Specific, Measurable, Achievable, Realistic, and Timely. Here's an example:

This is from RDM Group, a privately owned recycled cartonboard business

in Europe. This set of goals in the company's 2021 Sustainability Report is impressive to me because the goals are simply stated with a clear base year benchmark, long term targets and current progress. You get the full picture, quickly. Nothing fancy. The targets cover a range of sustainability topics rather than only climate or environment like many companies. Also, each of these targets represents progress. I can't comment on the degree of stretch or effort required to deliver these targets - that's a question for another day - but the public commitment is credibility affirmative.

6. Pathways Are to Targets as Fish is to Chips

Great. You published your 2030 targets, or your Net Zero by 2050 targets. Fantastic. But how many of your leadership team will be around in another 8 or so years to deliver your 2030 targets? Even fewer in 2050. To really get the credibility brownie points, you need to show how you will achieve these targets. Climate change reporting is getting better at this, with many companies sharing a pathway to Net Zero target delivery. But in almost all other areas, it's a guessing game, especially if the current performance is a step change away from the targeted performance.

Anglo American's 2021 Sustainability Report provides a Net Zero by 2040 pathway that visualizes the complex elements of their decarbonization plan.

7. Comparability Will Always be a Myth

The thing about standards and frameworks is that there are always gray areas, and there are always companies who bend the rules, smoothen the edges and adapt the guidelines to what they can or want to disclose. Perhaps regulation might make a difference, but standards need to be extremely prescriptive in order for companies to use them in exactly the same way. Take a simple metric such as "Percentage of women in management". Every company has a different definition of what constitutes a management position, from first line supervisory to senior executive. Any benchmark I have ever done (and I have done many) of reports using GRI Standards are almost never comparable on a metric for metric basis. That's probably because no company is the same as any other, and the context in which any company operates is always unique to that company. I have never truly understood the obsession with comparability, between companies at least. For me, comparability for me means comparing any company against itself and its prior performance. That's why it's important to report consistently year on year, and explain any changes in methodologies or scope or underlying assumptions.

Companies that issue a detailed metric calculation methodology make it easy for report users to know how metrics were developed, especially non-standard ones. Kingfisher plc does this well each year with detailed explanation of every core metric reported.

8: Materiality + Materiality

Double materiality, or impact materiality and (sustainability-related) financial materiality, seems to be the way to go. Makes sense. Most of us want to know how a business is affecting our lives and the world (impact materiality) while the financial and investor community need to know how life and the world are affecting the business in order to evaluate investment risk. The material thing about materiality is that there is no universal methodology to define and prioritize sustainability impacts on and of the business. Many companies reference "importance to the company" or "significance to stakeholders" without actually defining what this actually means. Does importance to the business mean social license to operate or does it mean profitability? Does significance to stakeholders mean the issue is directly affecting them or that their general opinion is that the topic is important? Either way, companies should DEFINE what materiality means in their context and how they assess topics as material. In many cases, the process goes something like: "We created a universe of topics from a range of sources, we analyzed them with input from internal and external stakeholders and then selected the top 20 topics which were approved by the Board." This tells us nothing about the basis for analysis or prioritization. I believe there is an urgent need for a materiality assessment methodology to create a certain consistency in defining material topics.

My approach to double materiality is to first create a list of potential impact areas, drawing from internal and external sources, and, after due analysis and discussion, assign an impact level to each, based on criteria that include business strategy, scale, scope and long-term effects of each impact. The result is a list of impact material topics. To determine sustainability-related financial materiality, the start point is the list of impact material topics, which is analyzed using additional criteria to assess the impact of the topic on the company's long-term profitability and overall success. Both these outputs deliver a single list of material topics, where some topics are material from an impact and a financial standpoint while the rest are material from an impact standpoint only. There are no financially material topics that are not material from an impact standpoint - if there were, these would be part of the financial disclosures, not sustainability disclosures.

A good example of this is from Sri Lankan Talakawelle Tea Estates in their Annual Report 2021/2022.

Sustainability topics are assessed from both an impact and financial standpoint and all topics above a certain threshold are discussed in the Annual (and sustainability) Reports. Each topic is also correlated with risks and opportunities and explanations of how each topic was assessed in terms or risk or opportunity is described in detail.

As methodologies go, this seems good to me. (N.B. I first saw this type of double-materiality approach used by Enel's 2021 Sustainability Report (p38). That's worth a look too, including a detailed description of how they did it).

Here is another option from Westpac Group's 2022 Sustainability Supplement. It's a list with a few icons carefully positioned for visual interest. What I like about this is that it splits the material topics into two parts - those that are primarily impact materiality, and those that also have a sustainability-related financial materiality element and are therefore included in the Westpac Annual Report (although not necessarily financially material from a corporate accounting standpoint). This is also a clear double materiality approach.

9. Ditch The Mystery Matrix

There have been multiple debates about the materiality matrix over the years, and I have always maintained that it's a misleading, distracting and time-wasting visualization of materiality prioritization. We need to know which topics a company considers material from an impact and/or a sustainability-financial standpoint. From my perspective, if it's material, it's material. Period. I don't think we need to mess around with shades of materiality...high materiality, low materiality, average materiality.... what difference do these labels make in terms of management attention, resource allocation, due diligence? All material topics should be assigned the level of resource required to address the need, the relative priority is superfluous to requirements. Typically, when faced with lots of dots on a matrix, I look to see which are the top topics (top right) and which are the bottom (bottom left). I then always find myself wondering why the bottom left topics are actually ranked so low by comparison to the ones ranked so high. It's mostly a big mystery.

There are as many ways of presenting a materiality matrix as there are companies who publish them. But even disregarding the visual creativity, the force-fitting of dots or topics on a matrix is even more mysterious. Check this one out:

What's the point of having a matrix if all your topics are in one box? Why have 9 boxes when two will do?

Here's a similar unmatrix from Mondelez 2021 ESG Report. Why use a matrix representation for four equally prioritized material topics?

On the other hand, if some visualization is needed because you have several issues and a simple list might be rather long, there are other options. This one from Marvell's 2022 ESG Report is clear enough.

10. If it's Material, Write About It

This might be obvious to many, but if you have identified a topic as material in your materiality mystery matrix or list of material topics, then please include content about it in the body of the report. Too many times the list of material topics seems like a garnish on the side of the plate, and not the actual main course. How would you like it if you went to a restaurant and ordered spaghetti bolognese and all you got was spaghetti? Ideally, you should help your report users find your material content. Here's a good example from Asus's 2021 Sustainability Report that shows the description of each material topic and the chapter of the report in which the topic is discussed.

Annual sustainability reporting should concern itself with what I call the delta - the difference you made in the reporting year, i.e. actual actions and progress made. All the management approach and policy type disclosures are what I call evergreen, and do not need to be / should not be repeated every year. As an essential part of disclosure, however, they can live their evergreen life on the company website as reference documents for those who need them, with occasional updates when a policy changes. Eliminating this blurb from your annual report saves time and space and enables your report to be compact and focused and yes, useful. I am seeing companies do more of this these days. Here are a few:

Oracle Policy Positions - this is a single downloadable PDF with a set of positions, rather than single items on a website

(Disclosure: I count Johnson & Johnson and Caesars Entertainment as valued clients and assisted in development of their policy banks.)

12. Scope 3 is IN

If you haven't started to grapple with your Scope 3 emissions yet, now's the time. Scope 3 is buzzing and will be included in new (likely regulated) sustainability reporting standards going forward, requiring disclosure by Scope 3 component categories. Many companies are doing this well today, and those who disclose to CDP have generally considered this and created the relevant connections and reporting processes. Scope 3 is awkward of course because it relies on the collaboration of suppliers and other value chain players to collaborate in providing data.

Microsoft's 2021 Environmental Sustainability Report reports Scope 3 in detail and is super-informative about the ways it addresses Scope 3 management and disclosure.

13. Assurance is IN

And you are probably also aware that third-party assurance of sustainability disclosures is now becoming a must-have. Building confidence in reported data is seen as a critical building block of trust and credibility in reporting. That's not to say that assurance always catches every glitch, but it introduces a robustness to the reporting process that is advantageous to companies, whether it's required by law or not. Limited assurance or reasonable assurance, of part or all information will definitely be part of the new game plan for ISSB and CSRD going forward, and U.S. SEC disclosure requirements on climate will also likely be subject to some form of assurance. Better get ahead of the game with some external verification in the next reporting cycle, because, in my experience, if you have never ever externally assured your sustainability information, the first time will be a heavy lift, and maybe the source of a few not-so-nice surprises. Good to iron out the creases before you have to disclose them.

14. Ice Cream is IN

Do not even attempt to start preparing your next sustainability report without a freezer stocked with ice cream. Believe me, it's essential. I am actually dismayed that ice cream does not feature anywhere in the new ISSB or CSRD standard proposals. As a minimum, Maintaining a Continuous Ice Cream Supply should be a core reporting principle.

15. SDGs are More than Icons

It's almost not a sustainability report if it doesn't contain a selection of SDG icons, the most overused icons in the history of reporting. These days, every ESG strategy, every sustainability aspiration, every community case study and almost every second paragraph has an SDG icon or several in close proximity. Apparently we will respect your sustainability performance more if it's SDG iconized. That might have been the case when the SDGs were all new and shiny back in 2015. Now, it's SDG-wash. Unless you can be explicit about the SDG targets you are directly contributing to, it's probably not worth the extra ink. If your company truly endorses the SDGs as a strategy and not as an afterthought or a PR pickup, you will disclose how you are contributing to advancing which SDG targets with some specificity. General stuff like "We occasionally donate to food banks" is not a meaningful response to SDG 2 Zero hunger. Setting a target to increase women in management is not quite enough to advance SDG 10 Reduced Inequalities. These actions may be in the right ball park but it's like telling the taxi driver to take you to Arizona when your actual destination is Big Looney's Ice Cream Truck on Ruby Way in Cottonwood, Arizona.

Here's an example from Capgemini's 2021-2022 Environmental Sustainability Performance Report - explicit actions to support SDG targets.

The Airport Authority Hong Kong's 2021/2022 Sustainability Report does a similar job, with several targets for each priority SDG.

16. Design for Use

I recently posted about report design (what works well, what to avoid) so I won't reproduce all of that here. Let me just stress one point. PDFs are read online. ONLINE. No one prints reports. We read them on screen. That means they must be suitable for on screen reading. Logical, right? Cue: NAVIGATION TOOLS. We need a way of moving around the report quickly and efficiently without having to CNTRL+HOME to get to the contents page every time we want to find something. Believe me, having reviewed more than 130 reports in two reporting award competitions in the past couple of months, the amount of time I wasted clicking back and forth in unnavigable reports probably amounted to longer than it takes me to binge watch 18 seasons of Grey's Anatomy. There are so many easy navigation tools available to report designers from hyperlinked side or top menus to a navigation tool bar that has home, forward and back buttons and any other number of alternatives.

Hankook Tire and Technology's ESG Report 2021 2022 is easy to navigate. There is an unintrusive top menu that gets you back home and to any main chapter, and sections within each chapter are hyperlinked on each section lead page.

17. Out Your Board

As a graduate of the ESG Competent Boards Certificate Program (Business Professionals cohort, 2021), I am now keenly aware of the role of the Board of Directors in guiding corporate sustainability practice. I have also read Helle Bank Jorgensen's book, Stewards of the Future, that also reinforces the critical role that company directors play in guiding company's to address ESG challenges. Therefore, I look for evidence of the Board's impact and engagement in sustainability practice as I read sustainability reports. Occasionally the Chair of the Board may make opening remarks, in addition to the CEO (or sometimes one letter with two signoffs). Occasionally Board members are quoted. Even more rarely is there a picture of the Board or any additional insight from directors. I think this is an opportunity. Why not bring your Board out of anonymity in your Sustainability Report and let us see how engaged they truly are. Of course they are, right?

Here's a nice Board Statement in Wilmar's 2021 Sustainability Report.

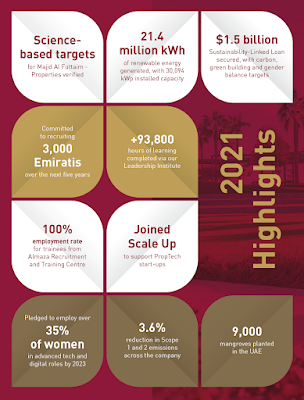

18. Highlight the Highlights

Reports are big chunky things that contain lots of information. Some companies publish Executive Summaries or short report versions for those who want the headlines without all the headaches. But even shorter than that, a highlights page in the early part of your report is a good way to get a few key messages across for those whose attention span is about 1 minute. It's also a good cheat-sheet for employees to use through the year in their interactions with their different contacts. Highlights pages come in many shapes and formats. Here's a few:

|

| Home Depot 2022 ESG Report |

|

| Kroger 2022 ESG Report |

|

| China Life Insurance 2021 Sustainability Report |

|

| Majid Al Futtaim ESG Report 2021 |

19. Check out ReportAdviser

I recently agreed to become an Ambassador for ReportAdviser, a useful reporting hub for professionals that brings sustainability disclosure guidance from multiple reporting standards and frameworks with reporting examples and explanations in one place. With GRI, SASB, NFRD, TCFD, ISO 26000, S&P's CSA, SDG and sector guidance materials, it's a quick reference guide that can be extremely helpful for reporters needing to check out reporting needs or benchmarking reporting examples without having to trawl through different websites and endless pages of reporting standards. There is also an ESG Data Search that enables you to input any search term and find related reporting examples. I input the term ice cream and got page examples of several sustainability reports mentioning ice cream. YAY! As the sustainability landscape is constantly changing, so ReportAdviser is continuously updating its database and guidance. Worth checking out!

20. Don't Be Late

The average time for publication of a sustainability report from the end of the reporting period is 3.4 months, according to WBCSD's 2022 Reporting Matters, now in its 10th anniversary edition. This is down from a six months average as per the very first Reporting Matters in 2013. In the past few years, report publication date within three months of the reporting period has been steadily increasing.

With GRI 2021 Universal Standards now requiring a publication date to be disclosed in sustainability reports (Disclosure 2-3c), and general pressure to create more alignment between financial and sustainability disclosure timing, a long delay between the end of the reporting period and publication of the sustainability report is becoming rather uncomfortable. Sounds like being at the party is not enough. You have to get there on time.

21. 80% of Something is Better than 100% of Nothing

While some may say it's important to strive for perfection, with about 160+ reporting projects under my belt, I feel justified in saying that perfection is a relative concept in sustainability reporting. It's practically impossible to satisfy everybody's demands and preferences in a single report that must meet multiple needs and disclosure requirements, even with the best of processes. In many cases, reporting managers must navigate demands from different parts of the organization, grapple with disclosures that many may prefer not to include, deal with delays in getting data, approvals, legal signoff, images and design work completed and a host of other challenges. Often there's a trade-off or two or twenty. So while there is no such thing as the perfect sustainability report, what there is is a published report that is the best that can be done under a unique set of circumstances in any company in any given year. It's part of a continuum of annual reporting that should keep improving. That's perfect enough for me. The idea is to embrace feedback / criticism / suggestions for the future and go at it again in the next cycle.

22: Make Your Report Work for You

You hit publish. The report is out there. Phew! Now it's time for a well deserved rest. But is it? Maybe a day or two. Immediately thereafter, there are three things you should be doing:

- Thanking all the folks who collaborated and contributed

- Starting the planning process for the next report

- Driving the outreach and communications plan to ensure the report actually gets used.

Your sustainability report has a life of several months (assuming timely publication) during which you have an opportunity to use it in a targeted way to continue to build trust and positively influence your company's reputation. Raising awareness goes beyond a single email blast to employees and an external Press Release. Your report amplification plan (which should have been developed well before publication date) is an important part of the reporting process. Use the months post-publication to genuinely engage with employees and onboard them as willing ambassadors of your company's sustainability progress and transparency. Repackage messaging and stories from the sustainability report to different audiences to drive real conversations about what works and what doesn't. Link up with business schools teaching sustainability and offer to engage with students about your report, answer their questions and respond to their criticisms. There are many ways to benefit from bringing your report to life after publication. After such a significant investment in producing the report, why not get a little mileage?

23: Surprise

There is no 23. This post is long enough. I am amazed you even got to 23. But it is an opportunity to say Happy New Year! Have a fun and productive reporting season!

😉

elaine cohen, GCB.D: ESG Competent Boards Certified (2021), Sustainability Strategy and Disclosure Specialist, former HR Professional, Ice Cream Addict. Owner/Manager of Beyond Business Ltd, an inspired Sustainability Strategy and Reporting firm having supported >160 client reports to date; author of three books and several chapters on Sustainability Reporting and the Human Resources connection to CSR; frequent chair and speaker at sustainability events and judge in several sustainability awards programs each year. Contact me via Twitter , LinkedIn or via Beyond Business