Last week, I dutifully submitted my feedback to the

International Integrated Reporting Committee on their discussion paper. It was an interesting exercise. Here are a few of my responses:

Do you believe that action is needed to help improve how organizations represent their value‑creation process?

Me: I believe companies need to take responsibility and be held accountable for their impacts on society. Action is needed to improve the number of companies who do this and the way in which they do it. This includes value companies create for society, but it is also about negative impacts on society and accounting for them.

Do you support the development of an International Integrated Reporting Framework?

Me: In principle yes, but on page 8, the Discussion Paper says that the IR framework will provide "high-level" guidance - I think it should provide very detailed guidance. Similarly, the approach states that it is focused on the needs of investors in the initial stages. I believe this is absolutely wrong. Integrated Reporting should AT THE VERY OUTSET focus on the needs of all stakeholders, otherwise it misses the point. Clearly, financial stakeholders are looking for tools to quantify the social/environmental risks and impacts in terms of shareholder value, but if this is the prime direction of Integrated Reporting, we are back to Square One, where sustainability is relegated to almost no influence on financial decisions and shareholder considerations. Once the framework has been developed for investors, there will be zero motivation to change or enhance it for all stakeholders.

Do you agree that Integrated Reporting will drive the disclosure of information that is useful for integrated analysis (from the perspective of investors)?

Me: Yes. In fact, that's pretty much all it will do. I don't think that's enough.

So, as I am having an integrated thinking week, I thought I would take a look at what's really happening out there and scan the

18 Integrated Reports that are contestants in the largest online annual Corporate Responsibility Reporting Awards - CRRA12.

Ultimately, a truly integrated report would show connectivity between the sustainability parts and the financial parts. Ultimately, a truly integrated report would make linkages between business strategy and sustainability strategy and define financial and social/environmental impacts of both in a seamless way. As I review the 18 reports entered in the Best Integrated Category, this is primarily what I am looking for. Connectivity. Linkage. Causality. Integration.

The IIRC discussion paper contains a couple of examples, including this one from Akzo Nobel:

Here we can an example of demonstrating financial value generated through response to global (green) market drivers.

As you will discover, in most reports, I don't find this degree of linkage. Most integrated reports today are a juxtapositioning of two separate reports. In the better cases, some of the narrative is blended so that business strategy appears to take financial, social and environmental aspects into account. Finding a report that actually considers the financial implications of sustainability actions is more difficult, though in some cases, the opportunities of sustainability strategy are discussed - sometimes using the

Porter Creation of Shared Value Concept as inspiration.

One thing that puzzles me, for example, is why the cost of energy or other environmental or social factors are not considered. Only one company in this Integrated Reporting Category reports the cost impact of energy - all others report only the KWH consumed and the GHG's emitted. Surely, energy conservation is both a sustainability and a financial risk/opportunity? Why would companies not wish to understand (and disclose) the financial impacts of their energy practices? This seems obvious to me but no-one does it. Yet.

Here are the 18 reports in the Best Integrated Report category (in alpha order):

Alma Media Oy, Annual Review 2010, Finland, 43 pages, GRI B

This is the first integrated report of Alma Media Oy, "the voice of sustainable media", a company whose reporting I have always loved, and this integrated version is great. It looks and feels like a Sustainability Report while ensuring the financials are included and well presented. There is a good deal of contextual information about markets and sustainability considerations. While it doesn't go quite as far as to truly integrate CSR issues into financial and business strategy, and lacks a materiality analysis (though it does include top subjects raised by stakeholders), this report is so well written that it almost make me want to read newspapers again!

Altron - Allied Electronics Corporation, Integrated Annual Report 2011, South Africa,

259 pages, GRI B+

This is Altron Group's second integrated report prepared in line with the King Report on Governance for South Africa (King III). It's a very official looking sort of report, not something you would want to enjoy reading, though it does provide a good range of data. The Company has identified 11 Strategic Themes and a set of Material Issues which are analyzed in the report in detail. There is a clear financial flavor to this report - although consolidated financials start only on page 143, in the early part of the report, much space is devoted to financial impacts and market reviews, including a CFO review and results highlights.

A material issue for Altron, energy consumption, shows a massive increase, from a total of 113,000 Mkwh to 218,000 Mkwh in one year, more than double:

In fairness, there is some discussion of this in the report, and Altron is committing to improving measurement procedures and initiatives to reduce the Group's carbon footprint. However, I couldn't help wondering what the financial impact of this single environmental indicator had on Altron's overall budgets and exactly what Altron is planning to do to to make a change, and how this will impact operations and people.

Cebu Holdings Incorporated Integrated Annual and Sustainability Report 2010, Philippines, 174 pages, GRI B

This real estate company in the Philippines has been an integrated reporter now for 4 years, and although the Chairman's review opens with Dear Stockholders (and not Stakeholders), the company has a nice sustainability framework and the report is quite a pleasant read. Sustainability issues are dealt with well, and include external stakeholder commentaries. The Financial part of this report begins officially on page 123.

One of the things this company integrates alongside financial, social and environmental performance is its core values - Cebu is one of the only companies I have seen whose core values include the Love of God. I wonder if this is a condition of hiring?

Cermaq ASA Annual Report, Norway, 131 pages, GRI B+

This is a fascinating report about a company who makes a living from salmon farming and making salmon feed. Did you know that 70% more salmon was consumed in Norway in 2010 versus 2009? Rising salmon eating trends is due to more sushi and sashimi consumption by younger people in the West, emulating Japanese fish eating habits. As salmon demand increases and supply falls behind, salmon is getting much more expensive. This is good news for Cermaq who made more profits than ever before in 2010. Another fascinating aspect of fish farming is the monitoring of salmon stress levels. Did you know that salmon could be in stress? Did you ever think about how much that salmon fillet you ate for dinner last week was stressed-out during its lifetime? Cermaq is able to identify stress levels in salmon and in 2010, was able to reduce stress levels by 60%. Wow. (Perhaps they could do the same for Sustainability Consultants?) Another fun fact is that Cermaq have 46 million fish in the sea as part of their farming effort and not one managed to escape. Hey, I bet prison services around the globe would be interested in Cermaq's methodologies.

Cermaq's Integrated Report is really a joined Sustainability Report and an Annual (Financial) Report. The Sustainability part takes up the first 55 pages and pages 61-131 are in the form of a traditional Annual Report. There are separate Auditor's Reviews for the Sustainability content and the Financial content. The Sustainability part contains a nice Materiality Matrix:

|

| Cermaq - nice Materiality Matrix presentation |

Cermaq have even created customized indicators for reporting on their own kind of sustainable aquaculture:

|

| Cermaq's propietary reporting indicators |

Deloitte LLP USA Fiscal Corporate Responsibility Report, 50 pages, GRI B

Oops! What' this doing here? This is a CSR Report and not an Integrated Report. How come it snuck into the Integrated Reporting category:). If this report wins, the IIRC will go a little crazy, I suspect :)

Clearly Deloitte are a little confused :). Perhaps their involvement in

the IIRC Pilot program may help.

NOTE: UPDATE 23 December: Following my comments above, Deloitte has now confirmed that this report entry in the Integrated Category was an error and it has now been removed. However, Deloitte's report is still in the running in the

Best Creativity Category. Clearly, Deloitte is not confused. Just a small error. These things happen. Thanks, Deloitte, for the clarification.

Flughafen Muenchen Sustainability and Annual Report 2010, Germany, 194 pages, GRI A+

The Munich Airport Sustainability and Annual Report is a fascinating look at the full scope of sustainability issues which are relevant to airport operations which are complex and cover a wide range of social and environmental impacts. This report nicely discloses on workplace, climate change and environment activities, community engagement and stakeholder interests, and includes a full Materiality Matrix. The consolidated management report, beginning on page 130, contains financials as well as sustainability risks. As far as integration goes, it does a good job, though as with all other reports in the integrated category, financial impacts and sustainability impacts are handled as separate entities and the connectivity between them is not clearly articulated.

Hyundai Engigeering & Construction Co, Korea, Sustainability Report, 88 pages, GRI A+

The Hyundai Report also seems to be misplaced in this category. There are two pages of headline economic or financial data in a total report of 88 pages. Hardly an Annual Report and hardly an integrated one. Hyundai should have read the fine print more carefully!

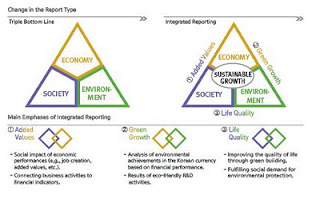

The report does include an explanation of the difference between a Triple Bottom Line Report and an Integrated Report and includes economic impact discussion and targets, though there is no direct linkage between these and other ESG performance areas.

The Hyundai Report includes a thoughtful Materiality Matrix which shows how issues have moved between one year to the next. This is a nice touch which most companies fail to consider.

The Hyundai report also features several external stakeholders and their responses to business and sustainability issues which are important to them as they consider their relationship with Hyundai. Overall, this is a great Sustainability Report showing consideration of social and environmental performance. The fact that some economic factors are mentioned and discussed does not make this a truly integrated report.

Indra Sistemas SA Annual Report 2010, Spain, 148 pages, GRI A+

Indra Sistemas offer a report which provides me with an opportunity to check out how much Spanish I don't know. I did try to use Google Translate, but when it converted a piece in Spanish to

"The accountability that is presented below was carried out following the guidelines of the G3.1 Global Reporting Initiative application level A + and as AA1000 APS (2008), Accountability, including our behavior on the Global Compact principles with which we compromised ...", I decided to give up and let the Spanish speakers among us analyze the degree of integration of this report. (The GRI Index is in Spanish and English). I did discover the

Indra Sustainability website which is in English with an online report which is rather pleasant, including a

"Sustainability Balanced Scorecard" which presents all sustainability data in great detail for a six year period. However, the website was not entered in the CRRA '12 competition so it is not really fair to comment on that.

This report is called a Sustainability Report and follows a classic structure of sustainability reporting, with economic performance, social performance and environmental performance making up the core sections of the report. The economic section includes 7 pages of business descriptions and profiles, but not a full set of financials and there is no reference to any other report which does include the full financial data. Here again, this report doesn't fit the bill for what I believe constitutes an Integrated Report, even using the "light" definition which may indicate a "combined" report.

MOL Group 2010 Hungary, Annual Report, 251 pages, GRI A+

This mammoth report by MOL Group oil and gas producer in Hungary, Slovakia and Croatia, includes a separate section on Sustainability non-financial performance which starts at page 175 and runs through to page 210 - 14% of the total report. More if you include the separate governance section which is a further 23 pages - bringing total sustainabiilty and governance content to 22%. One of the disturbing things about this report is the title of the sustainability section - "non-financial performance". Surely, in an integrated world, social and environmental performance can no longer be solely non-financial? MOL is not the only Integrated Reporter which uses this terminology which I think is misleading and not representative of integrated thinking. Aside from a mention of MOL's position in the Dow Jones Sustainability Index, sustainability issues are conspicuously absent from all discussion of MOL's business strategy and market performance. Sustainability data is assured separately from financial data.

The MOL sustainability component is very detailed and covers all transparency bases very well. However, the narrative is dry and factual and certainly not appealing to anybody other than those specifically searching for data and facts. In fact, MOL understands this, stating "While the Annual Report’s main audience is assumed to be our shareholders, investors and sustainability analysts, our

webpage is tailored to answering the information needs of all stakeholders." The website is a little more friendly for us non-financial people - it has a few more photos and the language is a little friendlier, though the pages are long and very detailed.

One thing I have never seen before in a published report is a draft GRI Application Level Check statement!

|

| MOL - getting ahead of themselves - confident of the GRI check! |

Novo Nordisk Annual Report 2010, Denmark, 115 pages, GRI A+

Novo Nordisk is often held up as the go-to-company for Integrated Reporting excellence, and has been a winner of the Best Integrated Report category in CRRA several times. Certainly, Novo has been doing this a lot longer than most companies (since 2004), so one might expect them to have developed a methodology which works for the company and for all stakeholders, not just financial stakeholders.

Novo says about their own report: "We believe Novo Nordisk creates value in ways that are not captured on a balance sheet or income statement and this is one of the reasons we publish an integrated report. Managing a business sustainably involves looking at risks holistically and taking a long-term perspective. In our 2010 Annual Report we exemplify this in a number of ways: comparing our sales growth with CO2, emissions, water usage and waste to better reflect relative performance and setting and reporting on long-term targets for diversity and engaging corporate culture."

De-coupling business growth from environmental impacts, is excellent, though Novo Nordisk continues to refer to non-financial targets and does not make the direct linkage between business and sustainability issues.

At the risk of becoming repetitive (yawn, zzzzzzzzzzzzzz), how can employee turnover, energy consumption, water consumption etc, not include an element of financial impact? Since 2007, Novo has achieved big reductions in water and energy consumption (37% and 28%) - I am sure this has made a significant financial contribution which is not specifically identified in Novo Nordisk's integrated reporting.

However, perhaps there is light at the end of the tunnel. I noted in an interview with Lise Kingo of Novo Nordisk, included in the report, that she says: "

Together with experts and with inputs from stakeholders we have developed a methodology that enables us to value the contribution of our Triple Bottom Line approach in a profit and loss perspective. We have called this initiative our Blueprint for Change programme, and we have conducted Triple Bottom Line reviews looking at our climate action strategy and our business approach in China." I found more about this

Blueprint for Change in China on the Novo Nordisk website - this is indeed an excellent document showing how Novo built business while creating very positive social and environmental impact. Again, I miss seeing an assessment of the impact of significant environmental benefits on the profitability and affordability of diabetes healthcare as part of this initiative, but this report does go further than most in identifying economic, social and environmental impacts for value creation as an integrated strategy.

The consolidated financial and non-financial statements start in the Novo report at page 57, though both financial and "non-financial" figures remain separate, with 7 pages out of around 58 referring to social and environmental impacts.

Solar World AG Annual Group Report 2010, Germany, 327 pages, GRI A+

This report is very long - at 327 pages, it weighs in as the second longest report in the entire competition. The report structure goes from corporate background and profiles (often quite technical) and then to consolidated financial statements, followed by a sustainability section which is made up of the GRI Index, the UNGC Index and the

KPI's of EFFAS, all of which take up a further 16 pages and is followed by some more detailed disclosures against performance indicators. There is little in the form of sustainability narrative - mainly data and while this is a business all about sustainability, I didn't detect too much overall integration in between financial and sustainability performance. It's quite a techy impersonal report in simple b/w design, making for a not terribly entertaining reading experience.

There is one page of economic narrative in this Sustainability Report. It's a Sustainability Report. Do Sustainability and Integrated sound so alike?

In fact, this report only barely qualifies as a Sustainability Report. It is so light on sustainability data that it would not make a GRI C Application Level. It's more of a marketing-oriented brochure that reflects Siveco's business performance with a couple of CSR themes thrown in for good measure.

While I commend Siveco for being one of the few Romanian sustainability reporters, and the only Romanian report entered in the entire CRRA competition, the Company needs to develop its understanding of what CSR and Sustainability really mean, and how this can be presented more effectively and transparently.

Syngenta International Annual Review 2010, Switzerland, 58 pages, GRI A+

Hah! This is the only report in this entire category which makes a connection between environmental impacts and financial results. Syngenta says: "We monitor energy use to identify opportunities to improve efficiency. Our energy strategy encourages local teams to select the best ways to reduce energy at local sites. By 2012, we aim to decrease global greenhouse gas emissions by 40 percent relative to EBIT from the 2006 baseline."

Energy consumption, GHG and other air emissions and water consumption all carry a $ value and are measured in terms of their impact on financial results as well as environmental sustainability.

The nature of Syngenta's business, developing seeds for more sustainable agriculture, advancing food security, lends itself well to a blended business and sustainability discussion, which makes the narrative in this report readable, informative and quite enjoyable. (Check out also Syngenta's

Grow More from Less website).The people section is light, and I would have welcomed more discussion about responsible workplace practices and a similar assessment and measurement of sustainable people practices in relation to cost efficiencies. Much of this can be quantified, and it would be an interesting next step for Syngenta to incorporate measurable people impacts in their next report.

In the meantime, given that Syngenta is the only report in this category which has made the connection I was looking for, as well as providing an integrated view of the business in a readable and accessible manner, without too much financial geek jargon and headaches, this report has my vote as the category winner!

(At this point, I will overlook the fact that this is a self-declared GRI A+ level report, and that several core indicators are not fully reported, which to me seems to fall below the A level threshold.)

Takeda Pharmaceutical Company Annual Report 2011, Japan, 150 pages, GRI A+

Takeda is a 230-old corporation so I guess they must be doing something right that supports their sustainability as an organization, although 2010 marks the first year of "Transformation into a New Takeda" strategy, driven by innovation, culture and growth. The reports looks and feels more like a Sustainability Report than an Annual Report, and includes extensive interviews with company people, and a thorough explanation of a significant acquisition, Nycomed, including aspects of culture and management style. (Most company reports do not examine in detail the basis for and impacts of acquisitions - this is a nice approach).

Financial results and discussion takes up 41 pages (27%) of this report, and some of the business and market disclosures in the body of the report are rather too detailed for the lay stakeholder to read and engage with, but overall, the report hangs together nicely, even though, as with other integrated reports, I could not find and direct connectivity between environmental or social performance and business results.

Takeda has adopted the seven core subjects of ISO26000 as a basis for CSR policy and reporting and structures disclosures around these themes. Takeda also publishes a

CSR Data Book which replicates all the information in the Annual Report and adds some, and also includes the GRI Index. So if you are looking for a more traditional standalone CSR Report, this is the one to view.

As with most Japanese reports, many messages are formulated into charts and diagrams. I liked this one which explains Takeda-ism and Takeda stakeholders.

Vancouver City Credit Savings Union (Vancity) 2010 Annual Report, Canada, 94 pages, GRI A+

Vancity is a member-owned, community-based credit union seeking to develop member and community value through everything it does. Vancity is Canada’s largest credit union, with $14.5 billion in assets, more than 417,000 members and 59 branches. Vancity calls this report "their first truly integrated Annual Report", and in my view, they have done a good job. Vancity's report gives a reasonably integrated business overview, with a financials taking up only 28 pages. One of the few integrated reports which has less bespoke financial content - and one of the few which is actually quite pleasant to read, with many nice visuals and a good storyline in the narrative. If you are wondering how Vancity manages to do this - I suspect I know why :) Take a look at the following shot of the Chair of the Board and the CEO! Women power is obviously the key!

Vancity's reporting on Materiality is interesting. In fact, they produce a

whole separate report about it - it's 4 pages long, and defines the materiality process undertaken and the specific priority responses received by stakeholders from different forms of engagement with them, and how these issues have been addressed in the Annual Report. While this is excellent practice and transparency, I do wonder about the decision to omit this, beyond a mention and referral to the separate report, from the Annual Report main document. Materiality process is so core to reporting, particularly integrated reporting - why push it out of the main document? Another nice touch I have always liked about Vancity's reporting is the way their targets are clearly laid out and the specific accountability for achieving each target is noted- once upon a time, Vancity included actual names of people but today, it's just the job title, such as VP Human Resources, CFO or other. Still, it's good to know who in the organization is accountable for what.

153 pages, GRI Undeclared level

Wow. You have to look at this report, just to see the spectacularly breathtaking photography! It's just too beautiful for words. The second reason you need to look at this report is to learn about the intricate details of cultural and sustainable tourism - the high level of detail this report provides is also breathtaking - some might say overkill - but it has a certain authenticity and charm which makes you want to read more. The report includes a list of issues raised by stakeholders and Wilderness's response to them.

Consolidated financial statements begin on page 108, however, so that is where I stopped :)

Wyndham Worldwide Corporation Sustainability Report 2009-2010, USA, 56 pages, GRI C

Oops! Another Sustainability Report. Not integrated. No vote in this category. It does include 2 pages about business performance and revenues, but this hardly constitutes a full set of financials. This report belongs in the Best First Time Report category. Phew! It's there. And also in the Best Carbon Disclosure Category. So that's alright then.

I couldn't resist taking a little peek, though! Two things caught my eye. First, is the Wyndham has a

website dedicated entirely to women travelers. I will have to see what that offers the next time I am off somewhere. I wonder if they supply people to pack and unpack my bags. That's by far the worst part of travelling.

The second thing I noticed is Wyndham's Sustainability structure, which seems highly slanted towards Environmental Sustainability.

|

| Wyndham - green is it |

Overall, the Report is a lightweight GRI level C report, responding to just 11 performance indicators in full. But a nice first time effort, all the same. Hmm. Wonder how it got into that Integrated Category, though!

And to round it all off...if you got this far ....

Of the 18 Reports entered in the Best Integrated Report category, there are five which I believe cannot be classified by any stretch of the imagination as integrated. Reporting companies should be more careful about how they define their entries in CRRA in future years. Also, some more specific guidance from CRRA might be helpful.

Of the remaining 13 reports, all go some way to presenting financial information blended, to a greater or lesser degree, with social and environmental impacts. However, very few manage to make a connection between business strategy and sustainability material issues in a way which shows how value is created or destroyed in both financial and sustainability terms. This shows the true nature of the leap that Integrated Reporting needs to drive. It is more than developing green products or delivering new drugs. It's about truly connecting all aspects of all business initiatives in which the sustainability impacts of business are represented in financial terms (where possible) and the business impacts of sustainability are represented in social and environmental terms (where possible). I fully recognize that 100% integration may be hard to achieve, but, based on my review of the Integrated Reports that are showcased here, even some first tentative steps would be significant.

elaine cohen, CSR consultant, Sustainability Reporter, HR Professional, Ice Cream Addict. Author of CSR for HR: A necessary partnership for advancing responsible business practices Contact me via www.twitter.com/elainecohen on Twitter or via my business website www.b-yond.biz/en (BeyondBusiness, an inspired CSR consulting and Sustainability Reporting firm)