And now for my third and final post about my adventures in Atlanta at the World Business Council for Sustainable Development (WBCSD) Council Meetings last week. I has to share this piece, as it's where everything comes together, and also, one of the most fun-important parts of the WBCSD activities. It's about the Future Leaders of our businesses and our sustainability efforts.

WBCSD has a fabulous program to educate future business leaders of the WBCSD member companies. It's a year-long program that provides tomorrow’s business leaders with "the skills and competencies to cope with an increasingly complex world as well as the social and environmental challenges across a changing competitive landscape." Each year is themed, and the 2015 program is all about "scaling up business actions on climate change & improving the business case" with modules in the U.S., Hong Kong and Paris. Wow. Wish I were10, 20, ok 30 years younger.

The 2014 Future Leaders Program (FLP) was populated with young up-and-coming mainly finance professionals from member companies and its theme was "Bridging the Capitals: Accounting for Natural & Social Capital in Business Decision Making". 25 young business people worked on this for a year, and delivered impressive outputs at the close of the program. In five teams, they worked on different aspects of the Bridging the Capitals theme and created reports that contain genuinely original and useful insights about reporting, measurement, materiality and more.

WBCSD has a fabulous program to educate future business leaders of the WBCSD member companies. It's a year-long program that provides tomorrow’s business leaders with "the skills and competencies to cope with an increasingly complex world as well as the social and environmental challenges across a changing competitive landscape." Each year is themed, and the 2015 program is all about "scaling up business actions on climate change & improving the business case" with modules in the U.S., Hong Kong and Paris. Wow. Wish I were

The 2014 Future Leaders Program (FLP) was populated with young up-and-coming mainly finance professionals from member companies and its theme was "Bridging the Capitals: Accounting for Natural & Social Capital in Business Decision Making". 25 young business people worked on this for a year, and delivered impressive outputs at the close of the program. In five teams, they worked on different aspects of the Bridging the Capitals theme and created reports that contain genuinely original and useful insights about reporting, measurement, materiality and more.

I highly recommend you take a look at some or all of these publications. I have read them all end-to-end and it was worth it.

Integrated Reporting in South Africa - From Concept to Practice: insights from interviews with South African reporting companies and investors.

Unraveling the Business Value Landscape: defining what value really means and recommendations on how to describe business value.

Integrated Performance Management: a quality approach to following through on sustainability commitments.

Sustainability - A new competence for financial leaders: a guide to help finance folks understand, navigate and even influence the sustainability agenda.

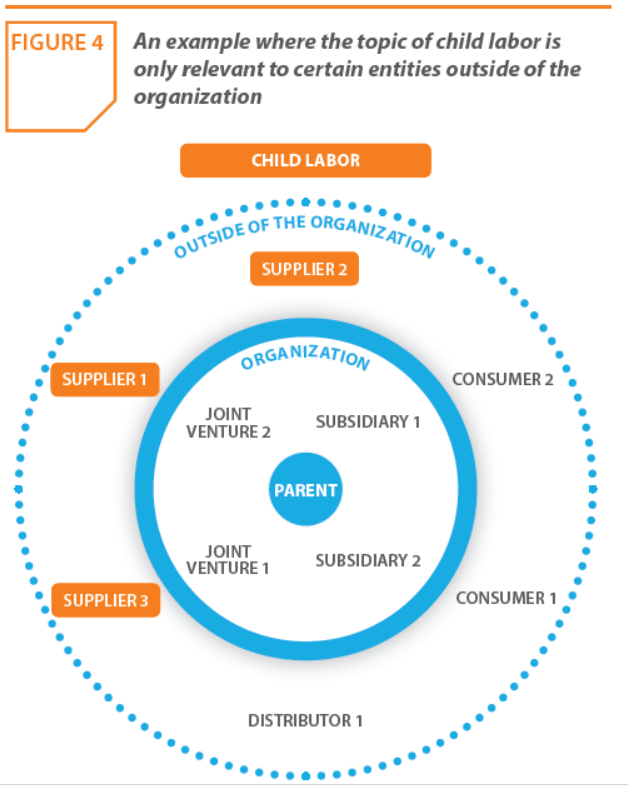

Journey to materiality- A guide to achieve corporate goals by applying materiality to environmental, social and governance issues: views and recommendations around the challenges of defining materiality.

One of the highlights of my week in Atlanta was being asked to present my perspectives and insights as an "expert" to this group. It's always nice to talk to young leaders and help shape their journey. Thinking about this, I wasn't quite sure what I could usefully add, given they were at the end of a year-long learning process. What could I tell them that they hadn't already heard? What could I add that could shape their journey further as they prepare for re-entry into the workplace with new sustainable-business shaded lenses? So, I used my trusty fall-back. When all else fails, build a model. In this case, I created a simple model designed to help these impressive young leaders remember to apply their learning as they grow and develop in their own professions. I called it the VITA model. Vita, according to the dictionary, is a biography or a resume. Quite fitting, I thought, because what I wanted to leave with the FLP participants was a thought about what they would want to see on their resume in 20 or 30 years time. What is the legacy of business activity they want to be proud of? How will their sustainability orientation show up in that 2030 resume? The VITA model has four main tenets:

VALUE – IMPACTS – TRANSPARENCY – ACCOUNTABILITY

VALUE: It may still be of value even if it you can't put a money number on it.

IMPACTS: We must talk impacts not actions and get better at defining them.

TRANSPARENCY: Transparency is not the goal, relevant transparency is the goal.

ACCOUNTABILITY: The finance function must be accountable to all its stakeholders.

In talking to these points, I shared some true (and in some cases, quite incredible) stories from my own experience as a business person over thirty years, and from my work with clients (no names named!). I won't fill up this post with stories ... but I will comment briefly on each part of the model.

VALUE: It may still be of value even if it you can't put a money number on it. Essentially, here, despite a week about capitals, costing externalities, measurement and metrics, I couldn't help but make the point that not everything can be quantified scientifically. For example, the impact of corporate culture. Sure, we can measure employee engagement, retention, attrition, satisfaction, development and even conflict in an organization, and we can measure the cost of non-compliance or non-ethical conduct to some degree, but can we truly measure a the money value of a culture that is ethical, open and empowering? In corporate cultures where there are aspects of complicity, lack of freedom to express new ideas or lack of respect for human worth, the ripple effects are far-reaching but we don't know exactly how to count them. As young leaders, especially ones with a head for finance, it is crucially important to remember that, at the end of the day, business is just people trying to survive and thrive. Valuing them and valuing values is just as important as valuing value. Even if you can't count it.

IMPACTS: We must talk impacts not actions and get better at defining them. I have said this many times, and often refer to "shopping-list" reports where I get what companies did but I didn't get what difference it made. Companies, and finance experts in companies, are soooooo good at calculating the last cent of the return on a capital investment. Yet companies are proud to say they donated (or even invested) tens of millions of $ in the community when they have no idea what a difference it made. We need to get better at why we are doing stuff and what impact we are trying to have. The ways of calculating impacts are partly about money but also about a range of intangibles that affect people lives which are harder to calculate. But that doesn’t mean we should ignore these impacts or even attempt to define them in at the planning stage.

I work with a company called Netafim. Netafim is a world leader in drip irrigation – a climate-smart agricultural process that enables better yields, using less water and less fertilizer and less energy. The economic cost benefits of drip irrigation can be calculated and in each market, Netafim has amassed a range of data that supports and quantifies the environmental and economic impacts of using drip irrigation. However, there are also many intangibles. How do you factor them into the equation? How do you design them into the planning? Rachel Shaul, the Marketing Director of Netafim went to Gujarat in India to talk to women farmers as part of a research project. Women's empowerment is a big thing in smallholder agriculture. The impact of using drip irrigation for them was the possibility of sending their kids to school, being able to buy a house for the first time or the ability to help other women become independent and self-sufficient.

|

| from Netafim Sustainability Report 204 |

How do you calculate the impact of that? Can you monetize that? Where would that get prioritized in the allocation of resources? Are these kind of impacts defined up front or are they a by-product that happens by doing business differently? Intuitively, supporting women smallholders makes sense. Objectively, data shows their economic situation improves. But how are all the other impacts on the quality of their lives calculated? When you are looking at the difference your company makes, these are the sort of things that should also be understood more deeply and taken into account.

We must get better at defining impacts in economic, social or environmental terms. We must get better at getting clearer about how a company is changing the world. And we must plan more holistically to deliver the impacts we desire to deliver. Some of that is about money, some of it is not.

TRANSPARENCY: Transparency is not the goal, relevant transparency is the goal. Everyone talks transparency, everyone believes that transparency is the goal. Everyone thinks that if they cram as much information as possible into a sustainability report or a website, that they will improve their reputation. Well, that may be. But in this world of overload, and with the increasing complexity of business, we don't need or want to know EVERYTHING. We want to know the most important things. How are those things defined and by whom? It's not easy. A materiality process can be designed to deliver the results you want to achieve. Getting granular and relevant on materiality requires good engagement. Engagement does not mean sending out a survey or having a meeting about your next contract with a supplier. Engagement means truly understanding the measure of impact you are having in a specific context and looking for the business risk and opportunities associated with that.

ACCOUNTABILITY: The finance function must be accountable to all its stakeholders. As finance managers or business leaders, who are your stakeholders? Who is affected by the impact of your decisions? Employees, of course. Management and their ability to advance positive reputation for your company and support business success, of course. But beyond that? Who do you have an impact on? What are the policies that you create that have an impact on society, the environment, the well-being of communities? How you establish investment policies, payment terms, restructuring frameworks and more? These all have an impact on the lives of people.

This is often highly relevant when businesses undergo restructuring. The key partners in any company that manage processes such as these are the Human Resources and the Finance teams. We decide, with our policies, whether people have a future or what kind of future they can start to plan. It's that simple.

U.S. Census data shows that more than 7 percent of American workers fell below the poverty line in 2012. Similar figures show up in Europe. Workers. Not people sitting on a beach somewhere. Workers. Going out every morning to a job and coming home and not being able to maintain a decent standard of living. Who's responsible for that ? HR? Finance? No-one? The competitive landscape? In the post-2015 agenda, the UN has begun to talk about eradicating poverty. Business has a role to play here, and so do finance managers and other business leaders. Who are your stakeholders? Are they the working poor? Or are they your management who wants to make more profit and show a better balance sheet? Of course a business must make money, profit is crucial to any business. But ultimately finance and business managers must be accountable for the impacts of their decisions, policies and actions on the way people live. And these elements must be factored into day-to-day decisions as well as in the bigger strategic directions.

This means considering all stakeholder impacts up-front in the decision-making process, and not just about balancing a budget. As well as considering the long-term impact of doing business in a world where poverty is omnipresent. Behind every number is someone's life. This isn't about the financial crisis, or big events that need big responses. This is about the day-to-day of our jobs and how they have an impact on stakeholders.

That was pretty much my message to these young leaders. VITA: Value, Impacts, Transparency and Accountability. That's the legacy. That's the 2030 resume. You'll notice that most of what I said was about people not about money and not about numbers. As young business leaders, this group has the power to make change and impact people's lives for the better. They can drive a different way of doing business that is led from a new vision, a new way of thinking about the role of business in society, a new way of creating value and a new way of being accountable. In some cases, that means accounting for externalities. In other ways, it means being a decent person and making decent decisions. It always means knowing what impact you are having on all your stakeholders.

*********

Finally, with this third and final piece in a trilogy of posts, I want to extend my personal thanks and gratitude to the folks on the WBCSD team that totally impressed my with their dedication, drive and skill and made me feel so welcome. Triple fudge with sprinkles to Rodney Irwin, Anne-Leonore Boffi and Susanne Feinman.

PS: One thing can't resist adding. I was very pleased to see in Peter White's (WBCSD COO) plenary presentation about WBCSD priorities, that he mentioned my company, Beyond Business Ltd. Hahahahah. Well, he didn't really. But it looks like he did. Or maybe it's just a case of "great minds think alike"!

PS: One thing can't resist adding. I was very pleased to see in Peter White's (WBCSD COO) plenary presentation about WBCSD priorities, that he mentioned my company, Beyond Business Ltd. Hahahahah. Well, he didn't really. But it looks like he did. Or maybe it's just a case of "great minds think alike"!

elaine cohen, CSR consultant, Sustainability Reporter, HR Professional, Ice Cream Addict. Author of Understanding G4: the Concise guide to Next Generation Sustainability Reporting AND Sustainability Reporting for SMEs: Competitive Advantage Through Transparency AND CSR for HR: A necessary partnership for advancing responsible business practices . Contact me via Twitter (@elainecohen) or via my business website www.b-yond.biz (Beyond Business Ltd, an inspired CSR consulting and Sustainability Reporting firm). Check out our G4 Report Expert Analysis Service - for published G4 reports or pre-publication - write to Elaine at info@b-yond.biz to help make your G4 reporting even better.